The first Litepaper of 2023, and the market is in the green! 🟢

We’ll see how long that lasts though; like a lifelong Minnesota Vikings fan, the longer you’re in crypto, the longer you become suspicious of anything good lasting a long time.

Today’s Litepaper is a detailed rundown of where Bitcoin is from a technical perspective. No SBF this and FTX that – today is all voodoo magic Hogwart’s wizardry Warhammer 40k technical analysis. 🔮

$ETC.X is the clear winner of the day, leaps and bounds above anyone else. There’s a strong hint of some selling pressure coming into crypto as the normal trading hours wind down, so we’ll have to see how it all plays out.

Here’s how the market looked at the end of the trading day:

| Ethereum Classic (ETC) |

$18.87

|

19.89% |

| Avalanche (AVAX) | $11.99 | 5.92% |

| Cardano (ADA) | $0.26 | 5.02% |

| BNB (BNB) |

$255.79

|

4.25% |

| Ethereum (ETH) |

$1,249

|

3.46% |

| Polygon (MATIC) | $0.79 | 3.06% |

| Uniswap (UNI) | $5.49 | 3.03% |

| Dogecoin (DOGE) | 0.07 | 2.53% |

| Chainlink (LINK) | $5.73 | 2.45% |

| Polkadot (DOT) |

$4.59

|

1.72% |

| Altcoin Market Cap |

$452 Billion

|

1.76% |

| Total Market Cap | $775 Billion | 1.30% |

Today’s Litepaper is diving deep into the technicals. But don’t worry; there’s a TL;DR (Too Long; Didn’t Read) section if you want to skip the nerd stuffs.

Let’s look at some prior Technically Speaking (T.S.) articles in the last half of 2022 that shine some light on what’s currently shaking for Bitcoin and the wider crypto market.

August 22, 2022, and August 26, 2022

The August 22, 2022, T.S. focused on where Elliot Wave analysts were looking at $BTC.X to move next.

Bullish and bearish cases were given. Below is an image of the chart highlighting the bearish case for Bitcoin moving into the $13,500 to $16,000 value area to complete Wave 5 if the $19,000 level fails to hold as support.

The August 26, 2022, Litepaper again warned that a close below $19,900 could trigger another leg south.

However, instead of Elliot Wave analysis, attention was given to what Ichimoku traders and analysts saw as a time cycle catalyst to watch and an important Fibonacci retracement level as support.

In a little over two months, Bitcoin would eventually fall into that value area described on August 22, 2022:

September 2, 2022

Beginning on September 2, 2022, the T.S. articles in the Litepaper highlighted areas analysts identified as a possible bullish turning point for Bitcoin (and the broader crypto market).

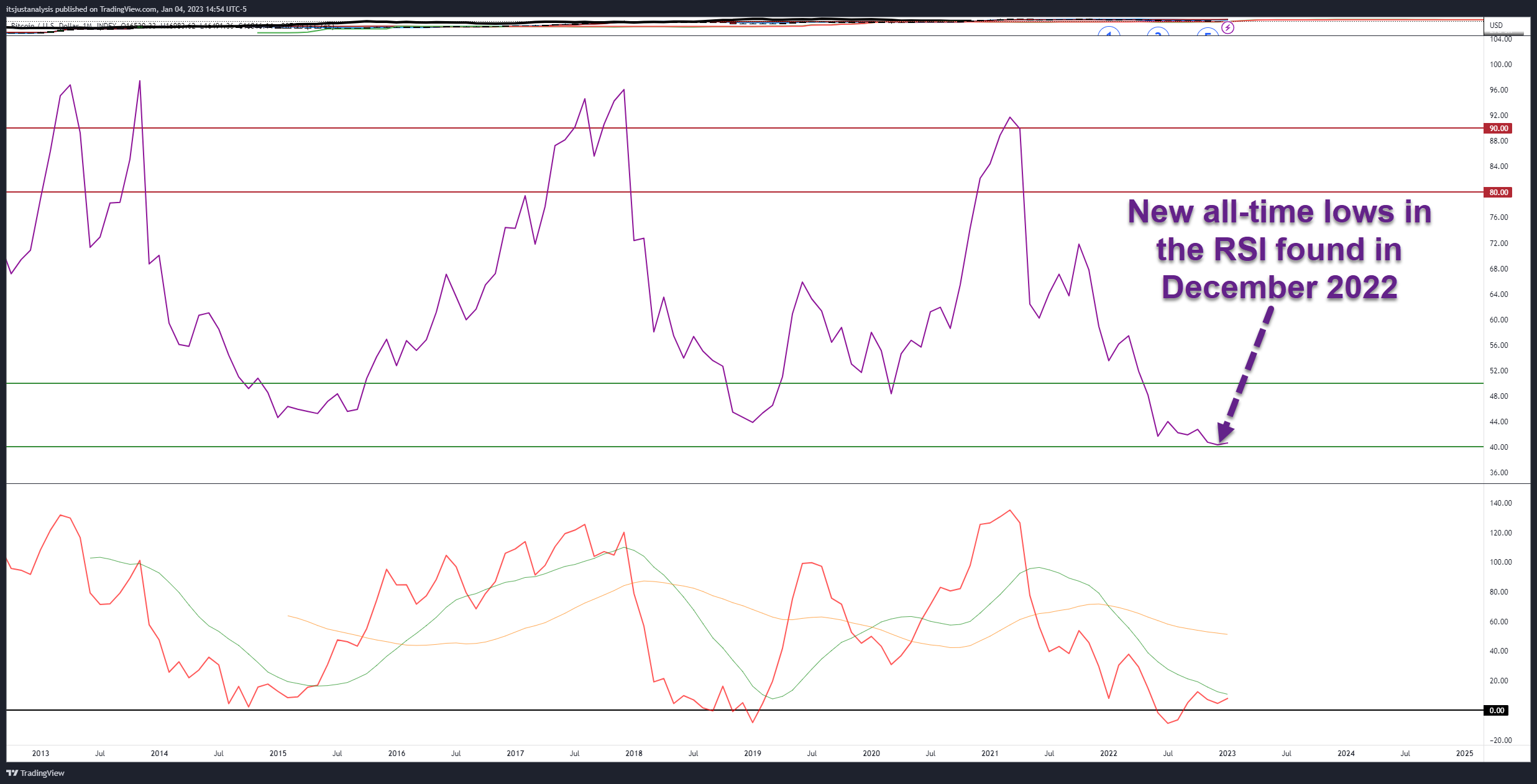

Analysts anticipated a corrective move for many reasons, including extreme lows in the RSI and the Composite Index oscillators on Bitcoin’s monthly chart.

Ultimately, the price action that occurred from September 2022 – December 2022 was a great cautionary warning against letting oscillators dictate the direction of anything – they are used to help confirm decisions, not create them.

And despite hitting new all-time lows in the RSI in September, the RSI made new lows again in October, November, and December:

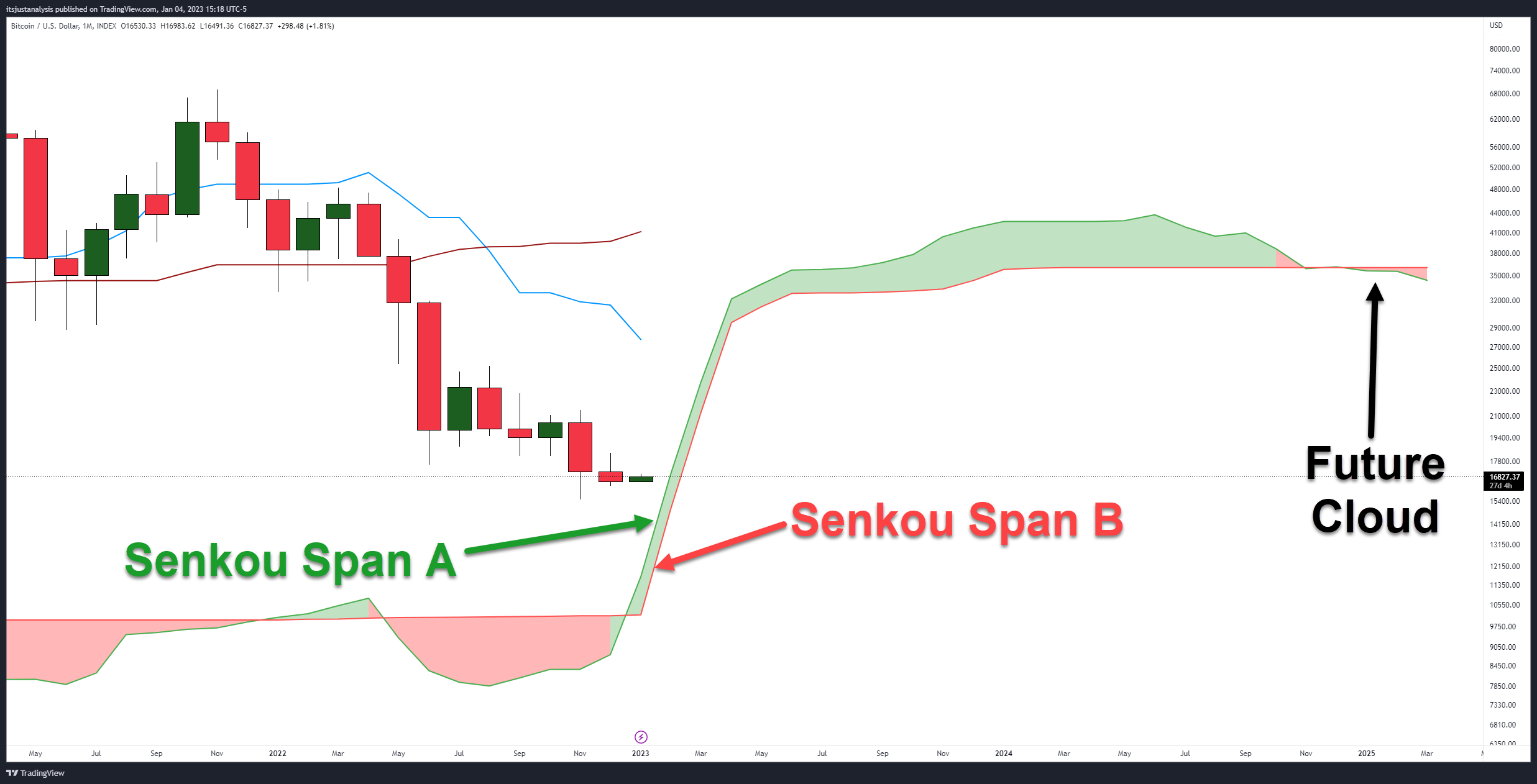

From a time cycle perspective, the September 2 Litepaper warned of an upcoming Kumo Twist between December 2022 and January 2023 in the Ichimoku Kinko Hyo system.

The TL;DR version of a Kumo Twist is a warning sign that a market may reverse/correct, especially if it’s been trending strongly into the Kumo Twist.

Moving to today, January 4, 2023, we can see Bitcoin has continued to trend lower right into the Kumo Twist:

These closing comments in the September 2 Litepaper highlight some important Ichimoku price levels for 2023.

“In either scenario, 2023 will be critical for Bitcoin within the Ichimoku system. Because in order for Bitcoin to maintain a clear and strong bullish trend, it will need to remain above the monthly Cloud.

The bottom of the monthly Cloud for 2023 starts at $10,000 and then moves dramatically higher until it reaches $33,000 in June 2023 before slowly increasing towards the $34,400 level in December 2023.” – September 2, 2022, Litepaper.

From an Ichimoku perspective, Bitcoin is sitting in a position that makes me want to nerd out – the next three months are going to be exciting to watch.

Why? Because of Patel’s Two Clouds Theory (at least, that’s what I call it).

In Manesh Patel’s book, Trading with Ichimoku Cloud: The Essential Guide to Ichimoku Kinko Hyo Technical Analysis, Patel calls attention to an Ichimoku phenomenon that no other modern Ichimoku analyst has called attention to in book form. This is what he observed:

When a major trend change occurs, the Future Cloud is thin, with both the current Senkou Span A and Senou Span B pointing in the direction of the Cloud.

It’s a rare condition that is currently present on Bitcoin’s monthly chart:

In combination with the big gaps between the candlesticks and the Tenkan-Sen (December 28, 2022, Litepaper), analysts still see a lot of upside potential for the crypto market.

While there are some immensely powerful bullish warning signs, follow through by those bulls is necessary.

Until the buyers step in, the path of least resistance is still lower.

Until it isn’t.

Too Long; Didn’t Read

For da Bears: If Bitcoin fails to hold support in the $16,000 value area, analysts see the next near-term primary support zone in the $10,000 – $13,000 value areas.

For dem Bulls: Analysts see a combination of time cycles, monthly oscillator values, and Ichimoku analyses, suggesting that a strong bullish corrective move could be imminent.

Bullets

Bullets From The Day:

🪙 $COIN just settled for $100 million with New York State regulators for violating anti-money laundering laws. Coinbase was accused of failing to conduct adequate background checks. $50 million will go to the New York State Department of Financial Services, and another $50 million requires Coinbase to spend on improving its compliance program. Coinbase’s chief legal officer Paul Grewal said, “Coinbase has taken substantial measures to address these historical shortcomings and remains committed to being a leader and role model in the crypto space, including partnering with regulators when it comes to compliance.” The Guardian has more.

🏦 The IRS would like to be cozy and friendly with cryptocurrency firms. Thomas Fattorusso, a special IRS-CI agent in New York, told the Wallstreet Journal that the IRS is not “… hostile to the technology. We have to embrace it.” He also voiced his desire for the IRS and the cryptocurrency industry to have a ‘symbiotic relationship. Hopefully not a symbiotic relationship in the form of parasitism – a symbiotic relationship where the symbiont (IRS) lives its life while feeding on and harming the host (the crypto industry) while also having a higher reproductive rate than the host. More from BeInCrypto.com

🦄 $UNI.X paid a bounty of $40,000 to the auditing and smart contract security firm, Dedaub, for identifying a potential vulnerability. Deedaub’s team found a way to attack Uniswap’s Universal Router, which could have allowed a third party to input code during a transaction between two accounts and effectively take the funds. Bounty programs in the cryptocurrency space are very common as they entice white-hat hackers and security firms to make a profit while discovering weaknesses in networks. U.Today has more.

⁉️ Curious about how much money was transacted over Bitcoin’s blockchain in 2022? More than you probably think. Despite the ugly bear market in 2022 (and still going into 2023), over $8 trillion was transacted over Bitcoin’s blockchain in 2022 – roughly $260,000 a second. More from Finbold.

🤔 Remember Three Arrows Capital (3AC)? Media attention on them went bye-bye after Do Kwon’s shenanigans, followed by FTX’s collapse. Co-founder of 3AC, Zhu Su, claims that the Digital Currency Group (CoinDesk, Grayscale Investments, and Genesis Global Capital are all under their umbrella) conspired with FTX to collapse $LUNC.X in May 2022. Zhou claims that “They (Digital Currency Group) took substantial losses in the summer from our (3AC) bankruptcy as well as Babel, and other firms involved in GBTC. They could’ve calmly restructured then. Instead, they fabricated a left pocket right pocket callable promissory note that magically filled the hole. This is like a kid losing at poker and saying ‘I am fine, my dad will pay you, let me keep playing,’ but if your dad is actually yourself…” DailyHodl has more.

Links

Links That Don’t Suck:

🤳 Indonesia to launch crypto exchange in 2023, to be regulated as “financial instruments”

🪙 Crypto payments volume in eCommerce climbs over 60% in 2022 – CoinGate report

👬 Genesis pressure mounts as Cameron Winklevoss threatens Barry Silbert

💂♀️ UK’s crime agency creates new crypto unit

☢️ War-torn Ukraine is turning to crypto

✂️ Video game testers approve the first union at Microsoft

🐲 D&D publisher Wizards Of The Coast cancels “At least five” video games

😣 Former SPAC CFO pleads guilty to funds misappropriation to trade crypto

📇 Nvidia announces that GeForce Now cloud gaming service is coming to select cars

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: