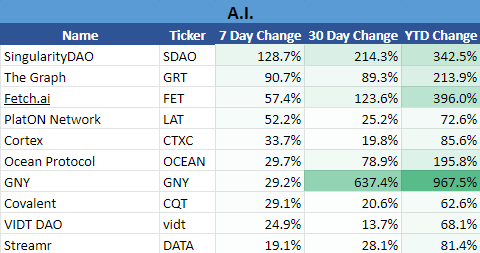

A new Stocktwits Crypto Index will be tracked from now on, the A.I. Index. 🦿

The A.I. Index comprises cryptocurrencies dedicated to making the Battlestar Galactica, 2001 Space Odyssey, I Robot, and the Terminator universes very real.

We construct this index by limiting the assets in this space to a minimum market cap of $20 million.

Overall, the index is up +140.98% over the past 30 days and up 208.92% YTD.

If the A.I. Index were included in last week’s indices, it would be the best performer YTD and the only one over 200%.

The other indices include the DeFi Index, DEX Index, Lending Index, Metaverse Index, NFT Index, Proof-Of-Stake Index, Proof-Of-Work Index, Privacy Index, Smart Contracts Index, and the Web 3 Index.

See how they performed for 2022 here.

Read the latest Saturday Litepaper issue here.