It’s been a rough run for social media companies over the last year, so investors were waiting on $PINS and needles for Pinterest’s earnings report today.

The company reported adjusted EPS of $0.11/share vs. $0.18 expected and revenues of $666 million, $1 million shy of expectations. 👎

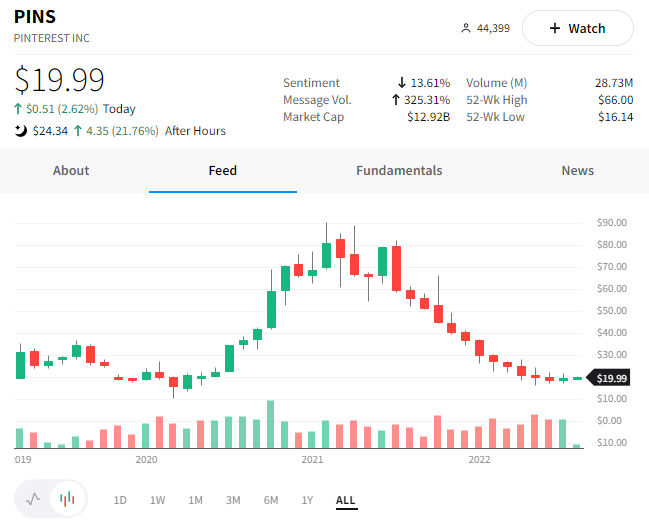

Despite the weak results, the stock actually popped 21% after hours! 😮

Investors are focusing on two things.

The first is global monthly active users, which declined 5% YoY to 433 million. While that decline isn’t great news, it was less severe than analyst expectations of 431 million. 🔻

The second is that activist investor Elliott Management confirmed that it is the company’s top investor and said it has “conviction in the value-creation opportunity” at the company. 👍

Maybe investor expectations have gotten low enough where bad news is okay, as long as it’s less lousy than expectations.

With that said, what is clear is that the online advertising market is weakening. Results from Meta, Twitter, Snap, Google, and other major players all cited a challenging macroeconomic environment in their reports. And uncertainty means less advertising spending until their ad customers get a better handle on their own businesses.

Pinterest furthered that narrative, stating, “The macroeconomic environment has created meaningful uncertainty for our advertiser partners…” and “…lower than expected demand from U.S. big box retailers and mid-market advertisers, who pulled back ad spend due to concerns about weakening consumer demand.”

The Federal Reserve is doing all it can to bring demand (and prices) down, so maybe we shouldn’t be surprised when it shows up in the stock market’s earnings. 🤷♂️

We’ll have to wait and see if this after-hours move holds or if this is another fake-out.

In the meantime, hop on the $PINS stream and share your view with us! 💭