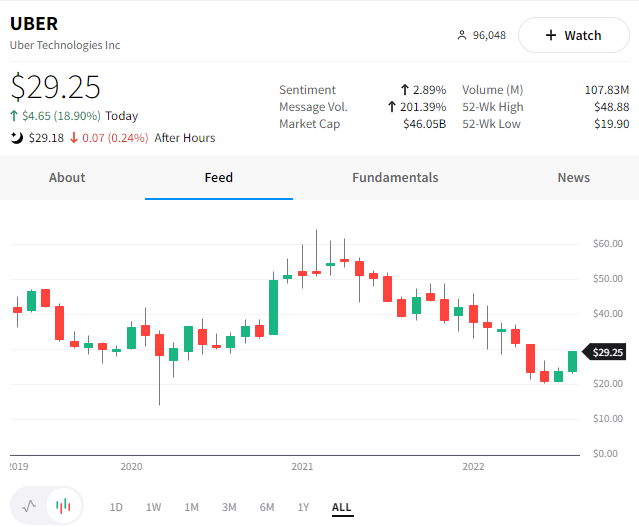

Uber shares declined nearly 70% since early 2021 but have turned a corner as of late. 🚗

The stock was up roughly 18% today after it reported revenue numbers well above expectations ($8.07 billion vs. $7.39 billion). The company has benefited from an increase in on-demand transportation and a shift in spending from retail to services, which other companies have highlighted. 📈

Active and new driver growth accelerated during the quarter despite higher fuel prices, with more drivers and couriers earning money than before the pandemic. Inflation is taking its toll, leading to more people turning to gig work to make extra money.

It did report a loss of $2.6 billion for the quarter, though $1.7 billion was due to a revaluation of its investments in Aurora, Grab, and Zomato. 📉

In addition to improving driver and user numbers, the company posted positive free cash flow for the first time ever ($382 million).

Investors are cheering today’s report so far, boosting shares of competitor $LYFT by 16.26%. 🎉

Hop on over to the streams and let us know whether you’re taking these stocks for a ride or steering clear. 💭