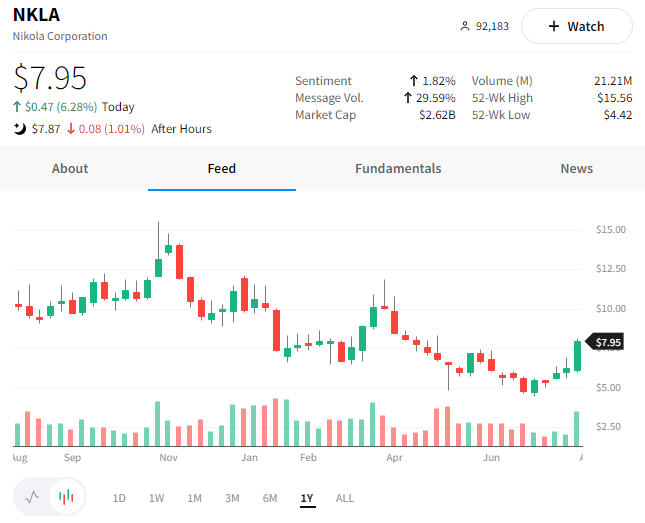

Lordstown Motors had a volatile trading session, ultimately closing up 1.71% after releasing its second-quarter earnings report.

The electric truck startup reaffirmed plans to begin commercial production of its first vehicle this quarter and roll out the first deliveries by the end of the year. However, its CEO Edward Hightower said production would be slow and heavily reliant on capital availability. It expects to produce about 500 vehicles through early 2023, which is very slow by industry standards. 🐌

Despite tepid news on the production front, investors are focusing on the fact that the company said it would need to raise between $50 to $75 million this year, well below its previous expectations of $150 million. For a company that has struggled to raise money effectively/efficiently in the past, an extended cash runway is a welcome sign.

The company did produce an operating profit of $61.3 million, driven solely by gains related to its Ohio factory sale to Foxconn. 💰

The stock’s volatility continues as uncertainty about the company’s ability to keep pace with well-funded competitors General Motors, Rivian Automotive, and Ford remains in question. Whether or not it can meet this quarter’s production goal of producing *one* vehicle will likely be a significant tell as to where its future in the industry lies. 🤷♂️

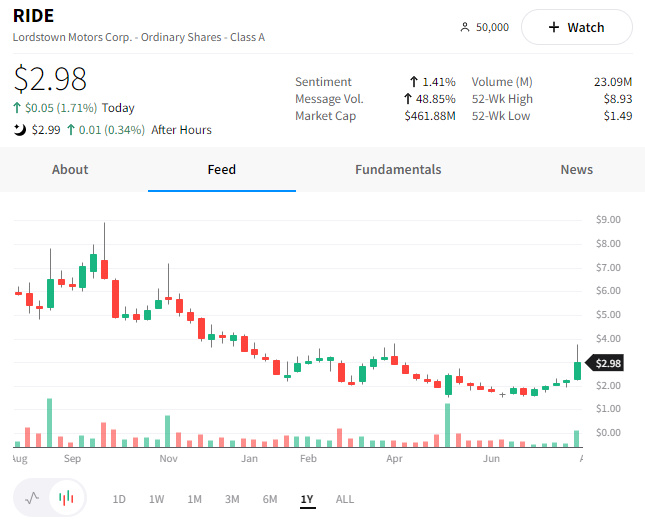

Meanwhile, Nikola shares rallied nearly 7% today after the company reported better-than-expected earnings and revenue. 📈

The company built 50 trucks in the quarter, 48 of which were shipped to dealers, and confirmed that it’s still on track to hit its 2022 deliveries guidance.

Its numbers also confirmed the company had significant cash on hand at the end of the quarter. Its balance sheet had $529 million in cash, with an additional $313 million remaining on its existing equity line of credit. 🤑

The stock is up nearly 28% this week after a string of positive news. On Tuesday, it won shareholder approval to increase its shares outstanding from 600 to 800 million, opening the doors for future financing. Additionally, it announced the acquisition of Romeo Power, giving the company control over a critical part of its supply chain. ⚡