While a good portion of the world deals with a major heatwave, Deere’s earnings report shows it’s facing a drought of its own. 🥵

The world’s largest farm equipment manufacturer lowered its full-year profit outlook and said it has sold out of its large tractors. The overarching sentiment is similar to what it expressed last quarter, that it’s unable to fulfill strong demand because of supply chain issues. 🏭

While it struggles to keep up with demand, those supply chain issues are eating into its profits. Total costs and expenses rose 24.4% YoY, resulting in an earnings miss but a revenue beat. 🔻

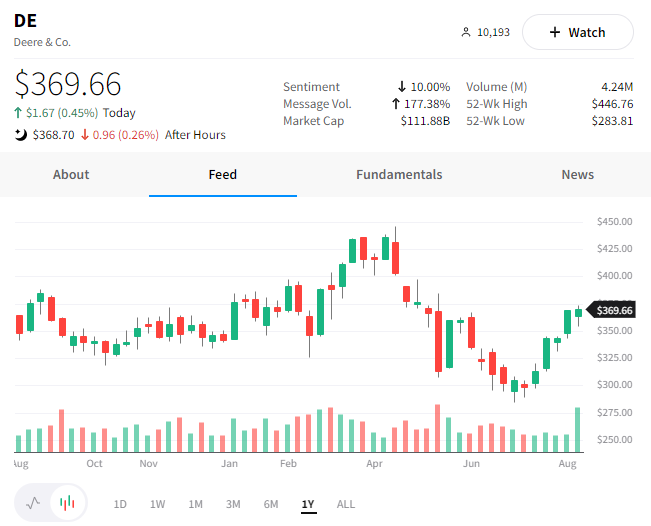

Despite another mixed quarter, the stock was more or less flat on the day. Investors appear to be focusing on its backlog of orders through early 2023 and hoping the company’s supply chain issues will ease in the year’s second half. 📆

Although commodity prices have come down as of late, but are still above pre-pandemic levels in many cases. Investors and analysts alike believe that will continue to buoy demand for Deere’s products in the coming quarters. 💪