Traditional retailers continue to battle the macro environment, changing consumer behavior, and a struggling business model.

Today before the market opened, we heard from two of them, Best Buy and Big Lots. 🛍️

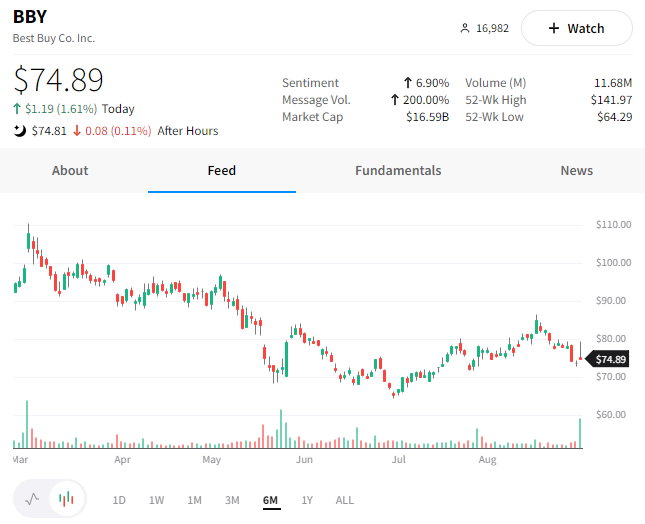

Best Buy, like many others, cut its outlook ahead of the report and was able to save face. Its earnings and revenue exceeded expectations, and the company reaffirmed its full-year guidance.

Consumers are spending more on essentials than discretionary items, forcing the company to increase promotional offers to bring in customers. Still, the change in consumer spending habits has caused same-store sales to drop 12.1% YoY, and the company expects a full-year decline of 11%. 📉

Overall, the news was less bad than expected, but investors expect more of the same from the company as it tries to cut costs and weather the weak environment. ⛈️

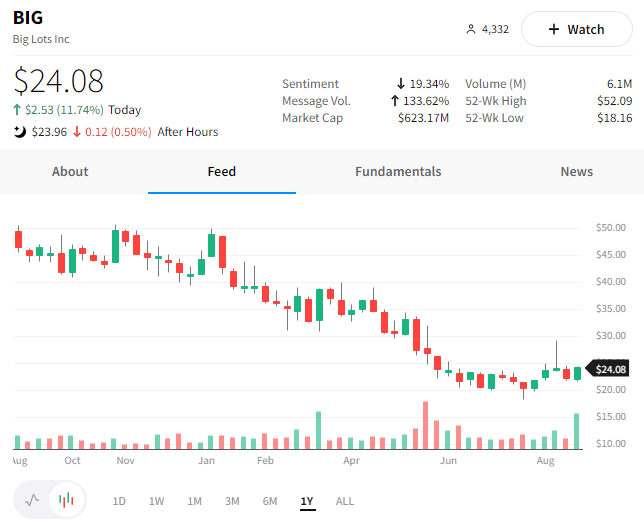

Meanwhile, discount retailer Big Lots managed to beat earnings estimates, reporting a loss of $2.28/share vs. the $2.47/share estimate. Additionally, revenue was in line with expectations. 👍

As we learned from Dollar General, discount stores are doing better in an environment where consumers try to stretch their dollars further.

In another case of “not as bad as expected,” the stock popped nearly 12% despite the mixed results.