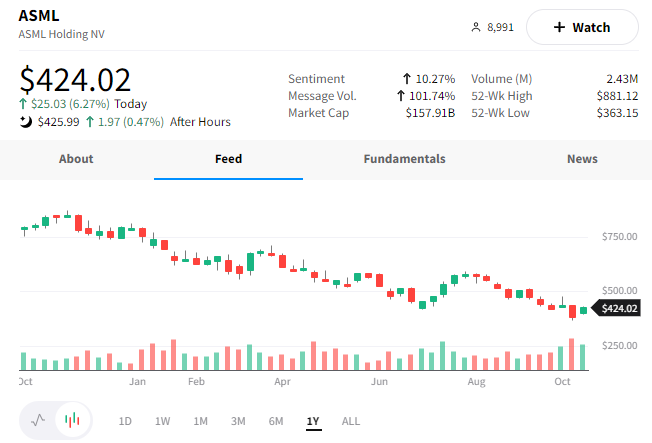

Semiconductor results have been pretty bleak lately, but today we had upside surprises from equipment-makers ASML and Lam Research. 😮

Starting with ASML, the company beat earnings and revenue expectations, bucking the global market slowdown other firms have warned of. Part of this is because it’s not a chipmaker itself but instead makes the machines chipmakers use for production. And if those firms want to stay on the cutting-edge of technology, they need ASML’s (and its competitors’) products.

With that said, the company’s CEO warned of the market’s uncertainty and that it’s starting to see diverging demand dynamics in some market segments. Overall though, demand for its systems remains strong. 👍

Additionally, the U.S. export curbs have been a big focus. However, based on the company’s initial assessment, the new restrictions will have a limited impact on the company’s overall 2023 shipment plan.

The results pleasantly surprised investors, sending $ASML shares up nearly 7%. 😊

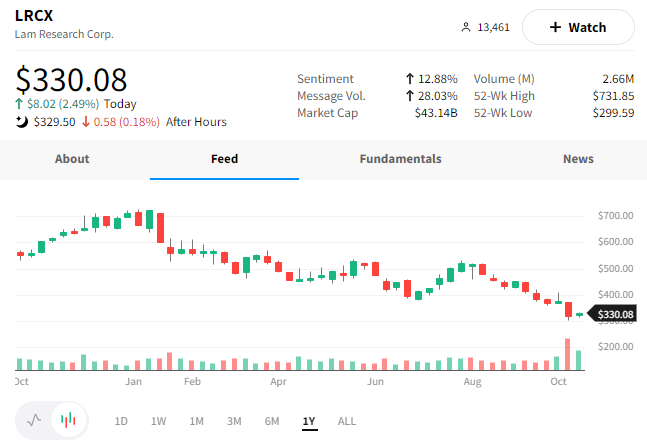

Similarly, chip-making-equipment supplier Lam Research beat expectations and raised guidance. 💪

The results helped ease investor concerns over a supply glut, with the company saying easing supply-chain problems present an opportunity. More predictable supply chains will allow it to manufacture backlogged products and meet the industry’s demand.

Its CFO, Douglas Bettinger, also told analysts, “I’ll remind you that we know how to manage this business during the down cycle.”

Shares of $LRCX also saw a boost today but are still sitting near 2-year lows. 📉

Lastly, it’s worth noting that Taiwan Semiconductor was in the news today. The company, which many know as Apple’s chipmaker, is considering a potential expansion in Japan as tensions rise in China. And they’re not the only one diversifying their operations. Just recently, Apple said it would manufacture some of the new iPhone 14 in India, with chances for further expansion. 🏭