Credit Suisse has been getting all the headlines lately, but other European banks don’t have the best rep either. So let’s check in on our friends Deutsche Bank and Barclays.

German lender Deutsche Bank easily beat the street’s expectations for earnings and revenue. It reported a net income of 1.115 billion euros vs. the 827 million euros expected.

Revenue rose 15% YoY to 6.92 billion euros. On the trading front, its fixed income and currencies trading revenue was up 38% YoY, offsetting weak credit trading. On the other hand, origination and advisory revenues plummeted 85% YoY as dealmaking dried up. Corporate banking saw the most significant increase, up 25% YoY, driven by rising interest rates.

One of the market’s key bank solvency measures is the Common Equity Tier 1 (CET1) ratio. Deutsche Bank’s CET1 ratio improved from 13% last year to 13.3 as it reduces risk and prepares for the weak growth environment and higher interest rate environment to continue. 🛡️

$DB shares are up marginally on the day, approaching their September and August highs as investors digest the news.

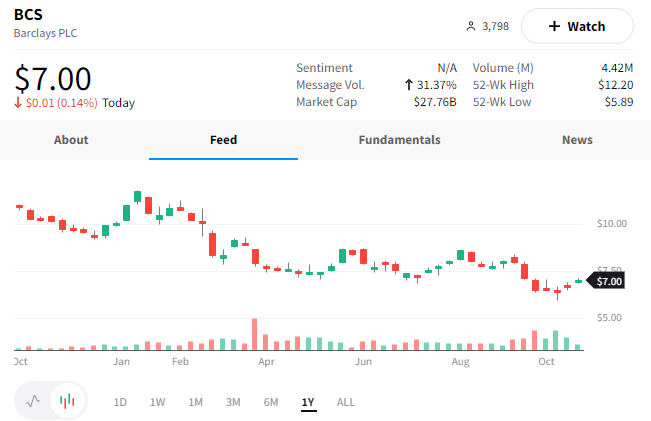

British lender Barclays also posted better-than-expected earnings and revenues.

Its net profit attributable to shareholders of 1.512 billion euros beat expectations of 1.152 billion euros. Revenue rose 17% YoY to 6.44 billion euros. The most significant driver of this was its FICC (fixed income, commodities, and currencies) trading business, which saw a 93% YoY rise in revenue. 😮

Like its peers, investment banking revenue suffered while a rise in net interest margin helped boost its consumer and corporate businesses. However, credit impairment charges rose more than 200% YoY as it copes with a deteriorating macroeconomic environment.

On the solvency side, its Common Equity Tier One Capital (CET1) ratio remains volatile. It came in at 13.8% this quarter. That’s down from 15.4% last year but up 0.2% from Q2.

The bank continues to grapple with legal troubles, paying nearly 1 billion euros in litigation and conduct charges this year. Some analysts say Barclays is the best-positioned bank in the U.K. but needs to avoid making costly missteps like its over-issuance of securities in the U.S. ⚖️

$BCS shares are down marginally on the day as investors mull over the results.

Markets are watching bank earnings closely to track how various parts of the world are faring economically. So far, expectations have been low enough for many to beat them. But, as always, we’ll keep you updated as more data comes in. 📝