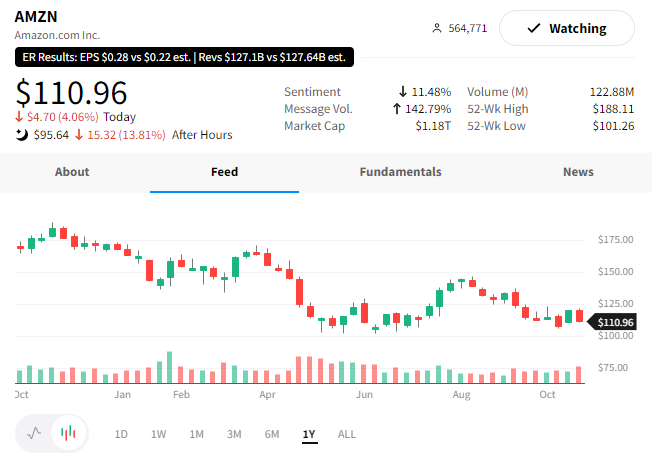

Anyone expecting Amazon to deliver solid results and save the market from its “tech wreck” is severely disappointed right now.

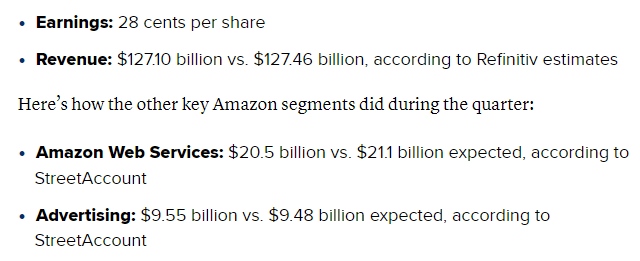

CNBC has a great summary chart of the report’s main metrics:

As we can see, the company missed on revenues, with its Amazon Web Services business falling short of expectations. This unit generated all of the company’s profit, generating an operating income of $5.4 billion. However, it experienced the slowest revenue growth since 2014, when the company made the unit’s results available. ⛈️

This is similar to the slowdown Microsoft’s Cloud business is experiencing, which is a major concern for investors who view that as the growth engine for many of these companies.

Surprisingly, its advertising revenue beat expectations despite peers like Facebook and Google missing in that department. However, that business is a small fraction of the company’s total revenue and could not offset the weakness in its larger units.

What’s really hitting the stock right now is the company’s guidance. It now expects fourth-quarter revenue between $140-$189 billion, which is 2%-8% YoY growth. That’s much lower than its third-quarter revenue growth of 15% and well below analyst expectations for $155.15 billion. 😨

Like other tech giants, Amazon says it is taking steps to reduce spending and prepare itself for a prolonged economic slowdown. That includes adjusting headcount, reprioritizing longer-term investments, and identifying further operational efficiencies.

Today’s report paints a dull picture of the coming holiday shopping season and does little to quell investors’ fears. $AMZN shares are sitting at their lowest level since April 2020 after-hours. 👎