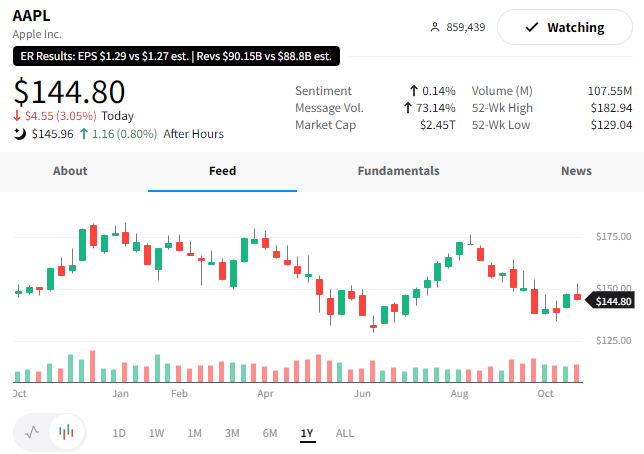

Apple didn’t completely smash expectations but stuck a softer landing than many of its peers.

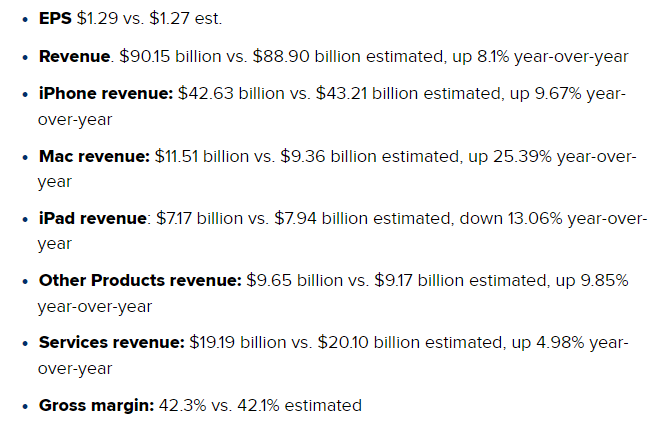

Let’s start with CNBC’s summary of how the company’s key metrics stacked up to expectations:

As we can see, earnings and revenue both beat expectations. Meanwhile, gross margins held up well, considering the current inflationary environment. 👍

Mac sales rose 25% despite competing PC firms pointing to a significant slowdown in the market. Additionally, its “other products” category, which includes wearables, rose nearly 10% YoY despite consumers pulling back on discretionary spending.

Getting into some of the negatives, iPhone revenue came in softer than expected. This isn’t too surprising, given a slowdown was hinted at by other cellphone providers, semiconductor makers, and Apple’s glass supplier Corning. But as the company’s largest segment, the headline number is always scrutinized.

The slowdown in the company’s Services revenue is especially of note. Investors like this segment because of its high profit margins and recurring revenue streams. So a slowdown from 12% growth last quarter to 5% now is disappointing. 👎

Those hoping for guidance for the company’s coming quarter, which is its biggest season of the year, were left hanging. The company has not offered guidance since 2020 because of uncertainty in the overall environment. With that said, the CFO did say that next quarter’s total YoY revenue growth would be less than the 8.1% seen in the current quarter. He also noted that Mac sales would decline YoY and that services growth would be slowed by the weak macro environment.

Overall, investors appear happy that the report wasn’t a complete disaster. As the world’s largest company, we’ll be all watching to see if its peers’ results drag $AAPL shares down or if they can continue to buck the bear market trend. 🤷