Yesterday we looked at European banks Deutsche Bank and Barclays, which fared pretty well.

Unfortunately, we heard from Credit Suisse today, which had investors saying sheeeeeeeeeesh. 😲

The struggling Swiss bank reported a third-quarter loss of 4.034 billion Swiss francs, well above expectations of 567 million Swiss francs. Driving that loss was a 3.655 billion Swiss franc impairment relating to its “reassessment of deferred tax assets as a result of the comprehensive strategic review.”

Essentially, the bank is preemptively recognizing losses that will occur from its future restructuring plan, which it provided more color on today. Executives are looking to restructure the company’s investment bank to cut its risk exposure and improve the bank’s capital reserves. They’re also looking to cut the bank’s cost base by 2.5 billion Swiss francs, or 15%, by 2025.

It will accomplish this by doing three things:

- Spinning off its investment bank into a new entity, CS First Boston;

- Issue new shares and conduct a rights offering to raise 4 billion Swiss francs; and

- Using that new capital to wind down its weaker, non-strategic business units.

If its transformation is successful, the bank says it will be much more stable and profitable than it currently is (talk about a low bar…). While it all sounds good on paper, we all know that execution is what separates the men from the boys. We’ll have to see if the bank’s executives can actually pull it off amid the challenging macroeconomic backdrop.

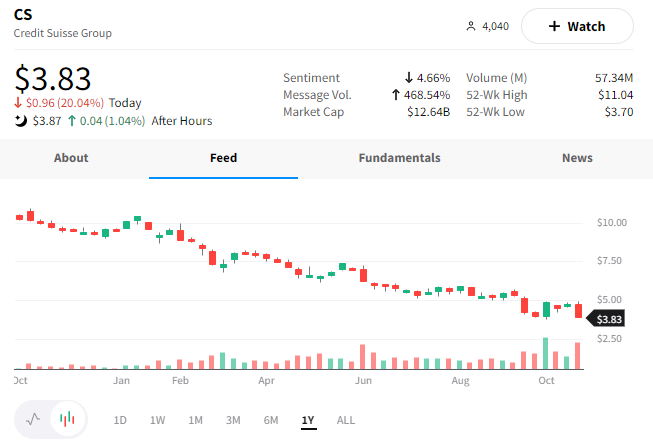

In the meantime, $CS shares fell 20% today and are approaching a new all-time low. 📉