Deere’s earnings report in August showed it was facing a bit of a drought, lowering its full-year profit outlook. Supply constraints left it unable to meet the robust demand of farmers, with rising expenses eating into profits. 👎

Today, it reported earnings per share of $7.44, which topped estimates of $7.11. Total revenues rose 37% to $15.54 billion, with equipment sales of $14.35 billion beating estimates of $13.39 billion.

The company also forecasted solid profit margin growth across its business segments. 🔮

Since its order books for most of its farm equipment and combines are full through Q3 2023, it can raise prices and offset some of its increased costs. Additionally, supply chain issues are beginning to ease, setting up for better production/delivery and reduced costs in 2023.

Investors were happy to see the company’s operating profits expand and that supply chain worries are beginning to ease. Lastly, the company’s outlook for improved construction equipment sales due to infrastructure spending was a nice kicker. 👍

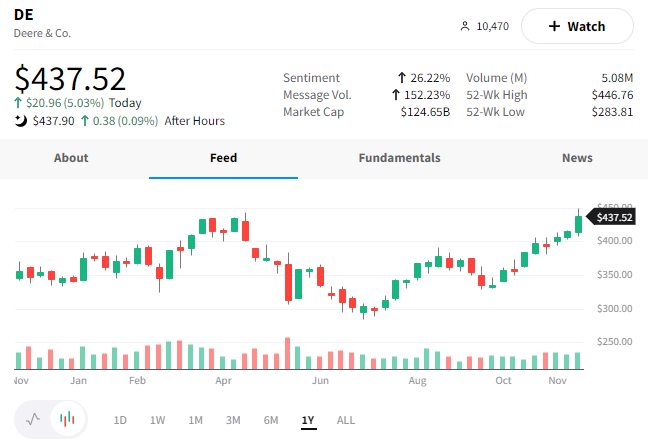

A solid report from the world’s largest farm equipment maker sent $DE shares to fresh all-time highs.