Earnings season continues; let’s recap today’s most prominent reports.

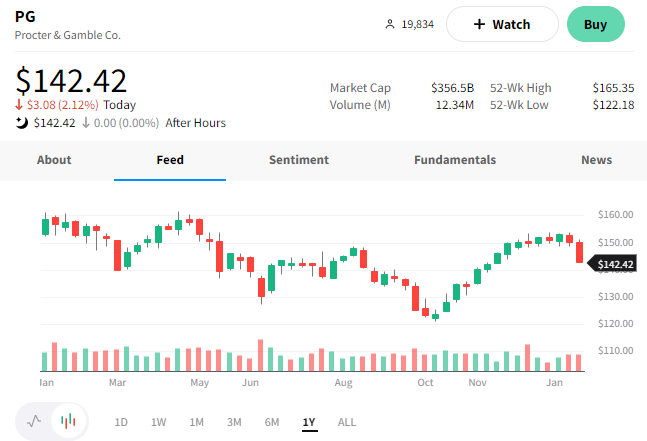

Consumer goods giant Procter & Gamble beat revenue and met earnings expectations. 📈

The company reported adjusted earnings per share (EPS) of $1.59 and revenues of $20.77 billion vs. the $20.73 billion expected.

The YoY declines in revenue and profit were primarily driven by declining volumes, with all of the company’s divisions reporting declining sales volumes. Executives noted that roughly half of the 6% decrease is due to weakening consumer demand, while the other half is due to overseas factors. 📦

Despite falling sales volume, the company will continue with planned price hikes. It even increased its full-year sales growth range by 1% to 4% to 5% and lowered its foreign exchange impact by 1% to 5%.

CEO Jon Moeller had this to say about the current macroeconomic backdrop; “The world seems to want everything to be better, as do I.” … “That’s not really the reality. It’s not the time to be taking guidance to the top range of possibility.”

Investors took the cautious comments to heart, sending $PG shares down roughly 2%. 🔻

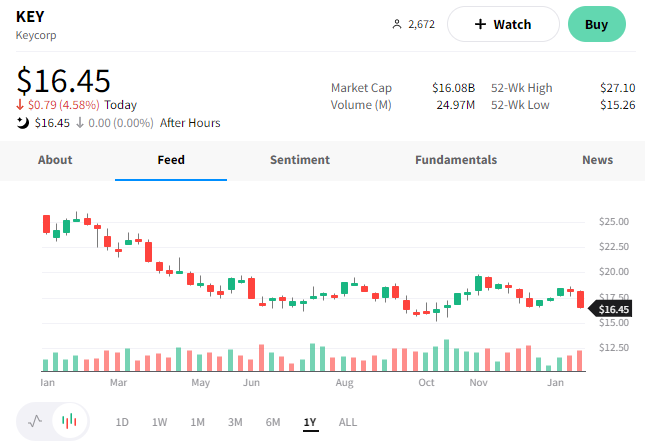

National bank KeyCorp reported earnings and revenue that missed expectations.

Earnings per share of $0.38 missed the $0.54 expected. Driving the decline was a deterioration in credit quality, including a provision for credit losses of $265 million. This was up from just $4 million in the prior-year quarter. Allowance for loan and lease losses also rose 26% YoY to $1.33 billion. 📈

Revenues fell 2.5% YoY to $1.89 billion, below the estimated $1.92 billion. The rise in net interest income and strong average loan growth supported revenues. However, a 26.2% drop in non-interest income weighed on the bank’s results. This non-interest income primarily includes mortgage income and investment banking/debt placement fees.

Investors are also concerned with the bank’s deteriorating capital ratios. That, combined with uncertainty over the consumer banking business in the current economy, pushed $KEY shares down 4.55% on the day. 📉

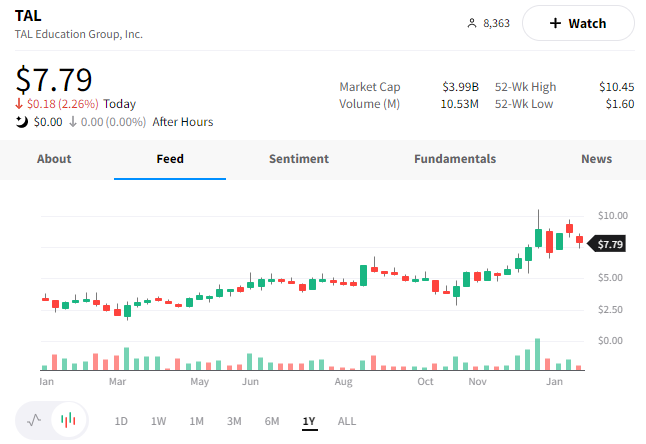

And TAL Education is worth noting because of investors’ recent focus on Chinese stocks. 🔍

The online education company reported earnings per share of $0.02 vs. the estimates for a $0.04 loss. Meanwhile, revenues of $232.7 million missed estimates of $239.8 million.

$TAL shares were down 2%, extending their pullback following a strong run. ◀️