So far this earnings season, consumer banks have fared pretty well. However, today we saw some very strong moves across the board. 💪

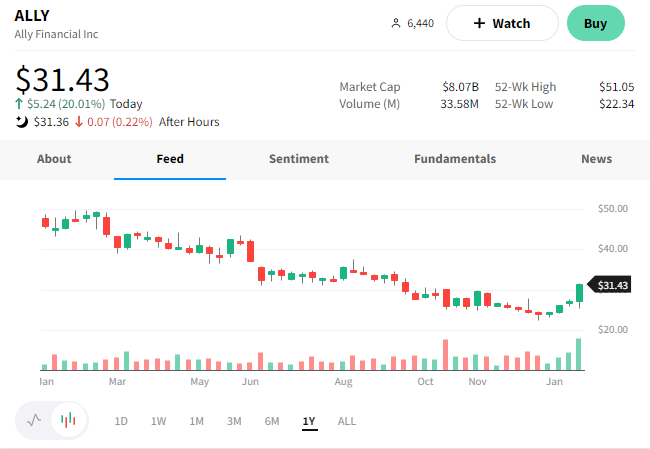

Leading the charge is Ally Financial, which saw profits decline but offered a strong outlook.

The company’s adjusted earnings per share (EPS) of $1.08 beat the $0.97 expected. Like other consumer banks, its profits were hit by it ratcheting up its provision for credit losses. 🔺

Overshadowing this quarter’s results was the bank’s forward guidance. It issued adjusted EPS guidance for 2023 ($4) and 2024 ($6), both of which topped estimates. Within that outlook is the assumption that U.S. GDP contracts in the first half of the year and unemployment rises to about 5%.

It also authorized a Q1 2023 dividend of $0.30 per common share. The rosy outlook sent $ALLY shares higher by 20% on the day. 😊

Next up is SVB Financial Group, which missed earnings expectations but reported stronger-than-expected investment banking revenue. 📝

A shareholder letter by CEO Greg Becker noted that the company experienced“solid loan growth, record core fees, better-than-expected net interest income, and healthy investment banking activity driven by Biopharma deals.”

Executives say the pace of decline in VC investment appears to be slowing and that clients are positioning themselves for a rapid resumption of activity once the markets stabilize.

The strong report and upbeat outlook from the parent of Silicon Valley Bank sent $SIVB shares 16% higher on the day. 📈

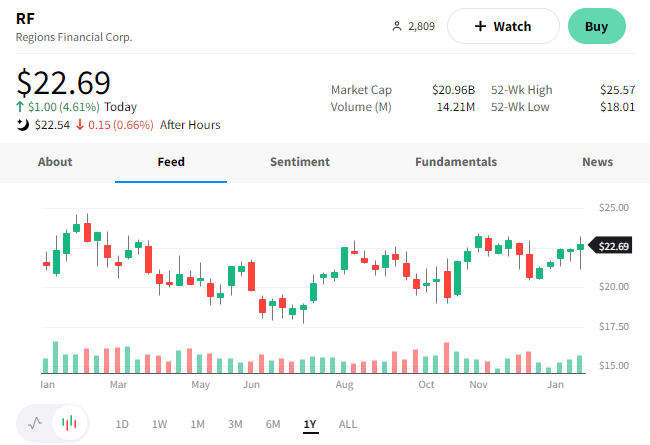

Regions Financial managed to beat earnings and revenue expectations.

The bank’s earnings per share of $0.67 beat the $0.65 expected. Meanwhile, revenues of $2 billion beat the $1.94 billion consensus estimate. 👍

Executives say 2022’s record performance provides a firm foundation for 2023, with full-year revenue rising 12% YoY.

$RF shares rose nearly 5% on the news but remain stuck in a year-long trading range. 🤷

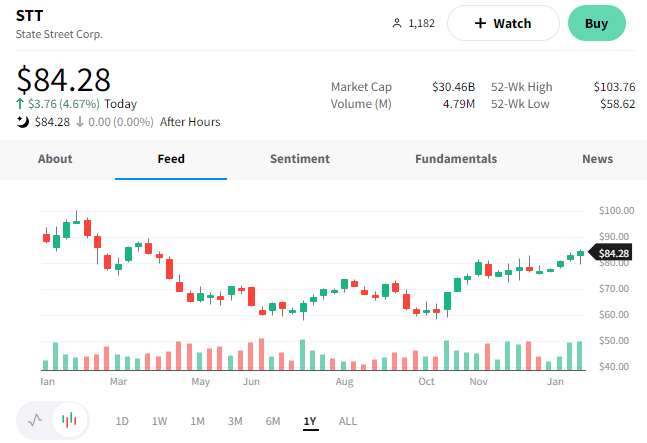

Last up is investment-management company State Street, which beat earnings and revenue expectations. 💰

Adjusted earnings per share of $2.07 topped the $1.98 expected, with revenues of $3.16 billion above the $3.04 consensus estimate.

Fee revenue fell 6% YoY, driven by the stock market decline and currency translations. However, net interest income rising 63% YoY offset that weakness. The company’s provision for credit losses rose to $10 million, though it’s a small part of their business.

$STT shares were up around 5% on the news. 📈