It’s another big day in tech earnings, so let’s just jump into it.

Dutch chip equipment maker ASML beat earnings and announced a lofty forecast for 2023 revenue. 😮

The company’s net sales rose more than 29% in the fourth quarter, with a 13% YoY rise for the full fiscal year. However, its net income for the year declined by roughly 4%.

Since it produces the machines required to make the world’s most advanced chips, ASML’s outlook is an important barometer for the industry. And today, it suggested that its net sales could grow 25% in 2023. 👍

While ASML’s executives recognize their business is not insulated from the macroeconomic environment, their customers believe the recent drop in demand will be “short-lived,” with many expecting a rebound in the second half of 2023. As a result, they’re not canceling orders, especially given the long average lead times for ASML’s tools.

It also noted that it remains in the middle of the U.S. and China’s battle over extreme ultraviolet (EUV) lithography machines, which are required to make the world’s most advanced chips. However, it can still ship its older products to China and expects 2023 sales in the country to account for about the same 15% of its total sales in 2022. 🌏

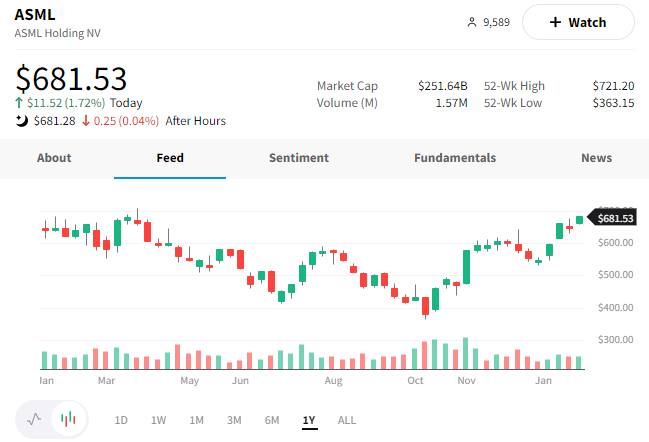

Overall, investors seemed pleased with the results as $ASML shares rose nearly 2% towards their 1-year high.

ASML’s competitor, Lam Research, did not fare as well. 👎

Despite beating this quarter’s earnings and revenue estimates, The company announced a weaker-than-expected outlook and restructuring efforts. As part of its plan, it’s laying off 7% of its workforce (1,300 employees), with many cuts coming in the U.S. manufacturing sector.

Additionally, it now expects revenue of $3.5 to $4.1 billion in the fiscal third quarter, falling well short of the $4.94 billion analysts expected.

Shares of $LRCX are down roughly 3% on the news. 📉

Next up is Seagate Technology, a major American data storage player.

The company reported adjusted earnings per share of $0.16 vs. the $0.10 expected. Revenues of $1.89 billion also beat the $1.83 billion expected. And for the fiscal third quarter of 2023, it expects revenue in the range of $1.85 to $2.15 billion and earnings per share of $0.05 to $0.45. 📆

Cash flow from operations was $251 million, and it had free cash flow of $172 million in the quarter. This allowed it to declare a cash dividend of $0.70 per share.

Investors are apparently happy with what the company had in store for them. $STX shares are up 7% on the news. 📈

Lastly, IBM is joining the list of large companies cutting jobs. With that said, its earnings and revenue did manage to top expectations. 🤷

Its adjusted earnings per share of $3.60 were in line with consensus. And revenues of $16.69 billion beat the $16.4 billion expected.

Analysts had expected revenue to decline for the first time in two years, but instead, it was flat. Driving that was strength in its software and infrastructure segments, which saw 3% and 2% growth, respectively. That offset the weakness in consulting, which grew 0.5% but fell short of expectations.

For 2023, it expects constant currency revenue growth to be in the mid-single digit range and a free cash flow of $10.5 billion. 🔮

Like other tech giants, IBM is also taking steps to reduce costs and boost earnings. That includes extending the useful life of its equipment, cutting 1,300 jobs (1.5% of its workforce), and more.

Shares of $IBM were down about 2% on the news. 🔻