Another day, another set of tech earnings. Let’s get into it.

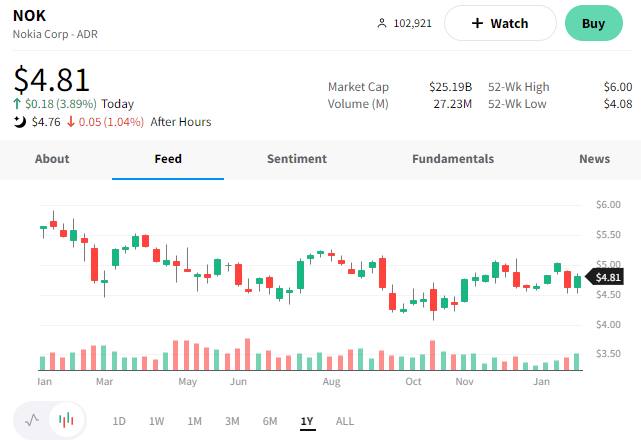

First, let’s start with Intel, whose report left analysts with many questions. 🤔

The company’s adjusted earnings per share of $0.10 missed the $0.19 expected. And revenues of $14.4 billion were also below the $14 billion expected.

Like its peers, data center and AI revenue was the sole bright spot. Despite falling 33% YoY, it managed to come in $0.3 billion above estimates. Client computing revenue was the major issue, falling 36% YoY to $6.6 billion vs. the $7.4 billion expected.

Its Q1 guidance also disappointed…badly. It expects an adjusted loss of $0.15 per share vs. Wall Street’s $0.25 per share profit. Revenues of $10.5 to $11.5 billion vs. Wall Street’s $14 billion. And gross margins of 39% vs. Wall Street’s 45.5%. 📉

In addition to the above, investors have expressed concerns that the company’s dividend could be in danger.

$INTC shares fell 9% on the news, dragging down its peers in the after-hours session. 👎

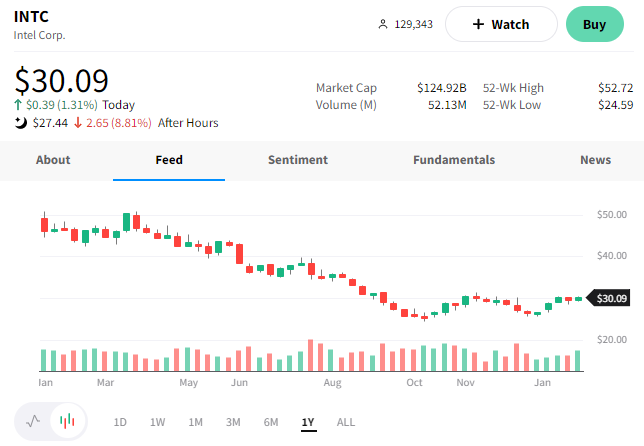

Next up is Comcast, which managed to beat estimates.

Adjusted earnings per share were $0.82 vs. the $0.77 expected. And revenues were $30.55 billion vs. $30.32 billion. 👍

Broadband customers fell due to Hurricane Ian, but excluding that impact, it would have added 4,000 customers. Regardless, its cable broadband subscriber growth continues to slow, much like its competitors. Similarly, its cable TV business lost 440,000 subscribers as cord-cutting continues.

Offsetting that weakness was its Xfinity Mobile business, which saw 365,000 net additions in the quarter. 📱

Investors also remain concerned about the Peacock streaming service, which continues to lose money. However, it added 5 million net paying subscribers in Q4, the best since its launch in 2020. That brings it to more than 20 million paying customers and revenue of $2.1 billion. Driving the strength was the increased demand for live sports programming, where we’ve seen other media giants investing heavily. 📺

With that said, 2022 losses of $2.5 billion were in line with expectations, and executives reiterated that the losses should peak at around $3 billion in 2023.

$CMCSA shares were up marginally on the news. 🦚

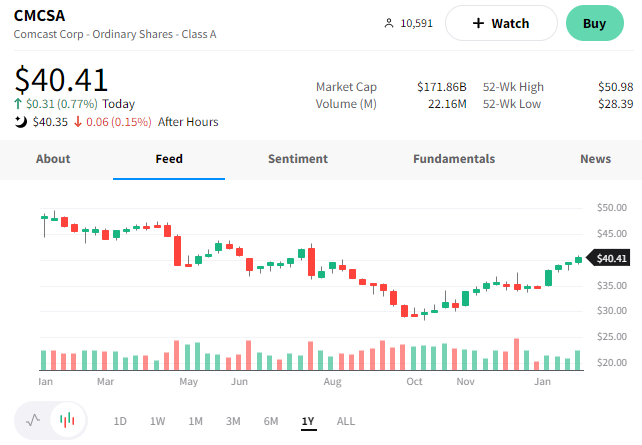

Lastly, Finnish telecom equipment maker Nokia issued an upbeat outlook for 2023.

While many have forgotten about the company, executives say it’s been able to gain market share by taking advantage of the 5G roll-out internationally, specifically in India. 🛰️

Executives’ demand outlook remains robust despite the macroeconomic uncertainty. They forecasted full-year net sales of 24.9 to 26.5 billion euros, while analysts expect 25.5 billion euros.

Its main competitor Ericsson did not fare as well. It reported weaker-than-expected earnings and expects its margin decline to continue into the first half of 2023.

$NOK shares were up about 4% on the day. 📈