SoFi Technologies has had a rough time since its IPO but received a boost today after reporting better-than-expected earnings. 🏦

The digital financial service company had a $0.05 per share loss vs. the expected $0.09 per share loss. Total net revenues of $456.7 million also beat the $423 million analysts expected. Its fourth-quarter adjusted EBITDA was up over 15x YoY to a record $70 million.

In addition to this quarter’s positive results, executives see the strength continuing into 2023. They now expect $260 to $280 million in adjusted EBITDA for the full year, well above analysts’ $246 million forecast. They also believe the company could generate positive GAAP net income in the fourth quarter of 2023. 💪

In terms of other stats, its total members rose 51% YoY to over 5.2 million. And total product adds were up 53% YoY to roughly 7.9 million.

Like other consumer-oriented financial services companies, it saw net interest income rise sharply and set aside additional reserves for credit losses as the economy softened. Additionally, personal loan originations are rising, offsetting weakness in their student loan and home loan segments. 💵

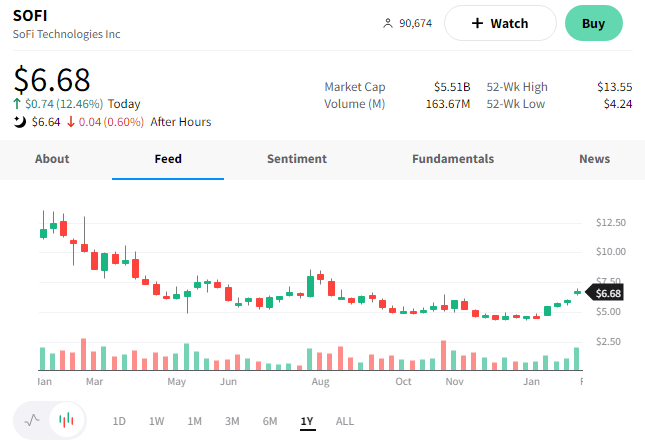

Overall, expectations were trending lower for the company and its stock price. But today’s beat and stronger outlook could be a turning point for its business and share price.

That’s at least what some investors are betting, as $SOFI shares were up 12% on the day. 📈