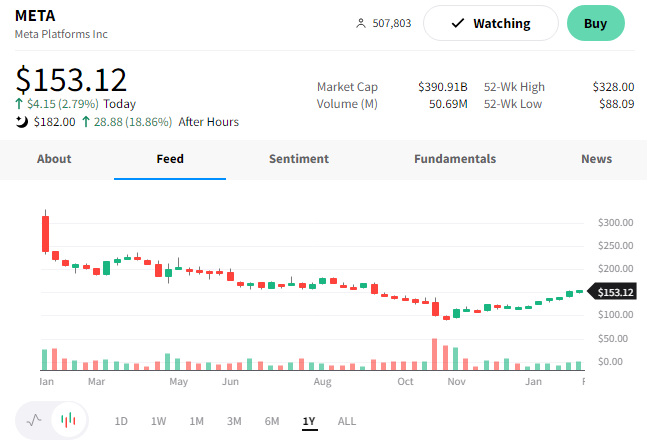

Don’t look now, but Meta’s stock has doubled over the last three months. Part of that move is coming after hours, where the tech giant released better-than-expected results. 😮

It reported adjusted earnings per share (EPS) of $1.76, missing the $2.22 analyst estimate. Partially driving that weakness was restructuring charges of over $4 billion incurred during the fourth quarter. However, total costs and expenses rose 22% YoY to $25.8 billion, so it’s hard to blame restructuring solely. 🔻

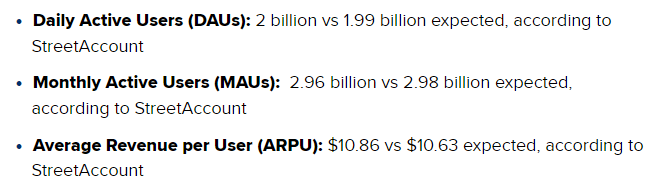

Overshadowing the earnings miss were revenue and user metrics.

The company reported $32.17 billion in revenue vs. the $31.53 billion expected. The 4% YoY decline marked the third straight quarter of declining sales. However, it reported the following key metrics as Zuckerberg highlighted community growth and strong engagement. 👍

With that said, Zuckerberg emphasized that the company’s 2023’s management theme is the ‘year of efficiency,’ with a renewed focus on becoming a stronger and more nimble organization.

As a result, the company expects full-year expenses of $89 to $95 billion in 2023, lower than its previous outlook of $94 to $100 billion. Driving that is slower payroll expense and cost of revenue growth. It’s also lowered its capital expenditure estimates from $34-$37 billion to $30-$33 billion. ✂️

On the sales front, it expects first-quarter revenue of $26-$28.5 billion. Last year’s numbers were $27.9 billion, and analysts expect $27.1 billion.

The company is still betting heavily on the metaverse as its next major growth driver. However, it’s taking steps to restart growth in its core advertising business and is “getting its fiscal house in order” by reducing costs where it can.

On top of that, the company is “buying the dip” in its own shares. It authorized a $40 billion buyback program, helping send shares of $META up 20% after hours to a 7-month high. 📈