Apple, Amazon, and Google experienced sharp runups ahead of their after-hours earnings reports. Optimism about the economy and Fed had already boosted tech stocks, but Meta’s upside surprise fueled the narrative that these three would also beat.

What ultimately resulted was some lackluster action after the bell. Let’s break it all down. 📝

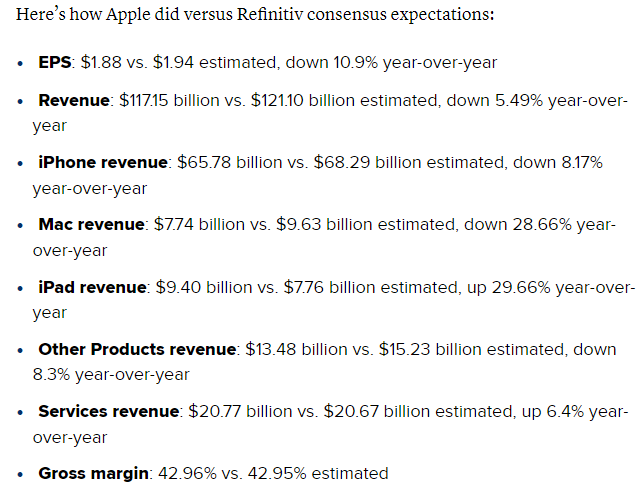

First up is the world’s largest company, Apple. CNBC’s outline below compares its primary metrics vs. expectations.

The company experienced a 5.49% YoY decline in revenue, marking its largest quarterly drop since 2016. CEO Time Cook said three factors drove those results: 1) a strong U.S. Dollar, 2) China’s production issues impacting the iPhone 14 Pro and Pro Max models, and 3) a weakening overall macroeconomic environment. 🔻

Apple did not provide guidance for the current quarter, but its CFO Luca Maestri said revenue would have a similar YoY trend as the December quarter. Services remain a strong component, with the company continuing to invest in new features like “buy-now-pay-later,” which will be launching soon.

Like its peers, the company is cutting costs but has avoided layoffs. Overall, it’s largely been able to sidestep many of the headwinds other businesses were hampered by over the last few years. Whether or not today’s miss was the end of that trend remains to be seen. 🤷

Investors appear to be staying optimistic after hours, as $AAPL shares are only down marginally. 🍎

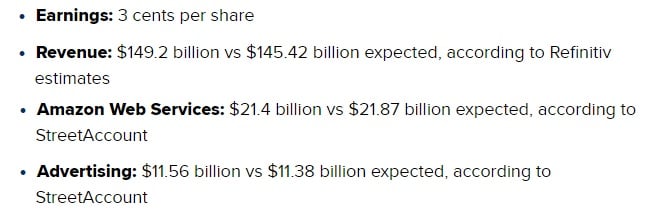

Next is Amazon, which beat current-quarter estimates but provided light first-quarter guidance. Below are their key metrics vs. estimates.

The company experienced its slowest year of growth as a public company, with revenue rising just 9%. The challenging macroeconomic environment is pressuring consumers, with Amazon’s online stores’ segment contracting 2% YoY. And its AWS growth halved from 40% to 20% in the current quarter. Advertising revenue was a bright spot at 19% YoY growth, but it remains a smaller business segment. 🛒

Looking ahead, it expects first-quarter revenue between $121 and $126 billion. That’s 4%-8% YoY growth and at the lower end of the $125.1 billion expected by analysts. 🔮

Executives say they’re encouraged by the company’s continued progress. Like its peers, the retail giant has been cutting costs and reprioritizing its focus. Most recently, its announced 18,000 employee layoffs impacting its stores and human resources divisions.

CEO Andy Jassy said, “In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon.”

Meanwhile, Amazon investors are still trying to figure out if they share that optimistic view. $AMZN shares are volatile after hours, currently down 4%. 👎

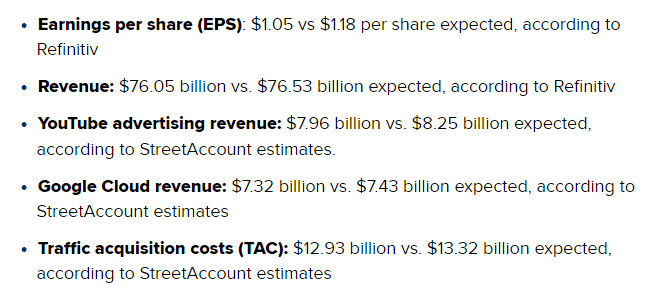

Last but not least is Google’s parent company, Alphabet. The search giant missed top and bottom line estimates this quarter. ❌

Below are its key stats vs. expectations.

Almost every company has telegraphed the slowdown in advertising over the last year. However, it’s apparently impacting Google more than many analysts initially expected. 😨

Within that slowdown is YouTube, which faces increased competition from TikTok and other short-form video platforms. Elsewhere, Google Cloud revenue managed to rise 32% YoY. While that’s less than expected, the company managed to reduce that segment’s loss from $890 million to $480 million YoY.

Operating expenses rose 10% YoY, driven by headcount growth, charges for legal matters, and lower ad spending. With that said, it’s being strategic with costs and reprioritizing to limit spending as tech companies tighten their fiscal belts. 🔺

Despite misses across the board, executives remain optimistic about the future. Addressing the hype around ChatGPT, they noted that the company is investing in Artificial Intelligence (AI) and should release some related products soon.

$GOOGL shares were down roughly 4% after hours, giving back two-thirds of today’s gains. ✂️