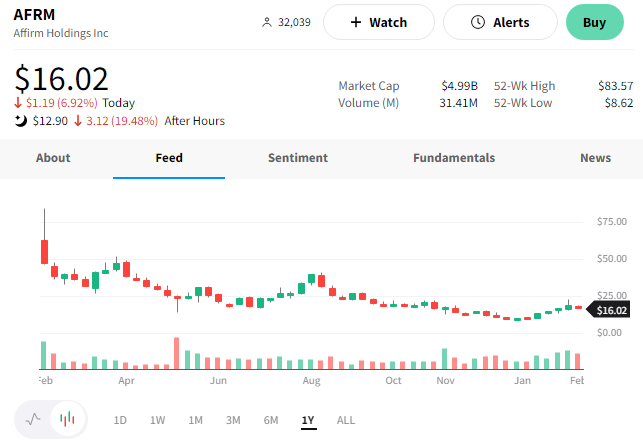

Buy Now Pay Later (BNPL) company Affirm is falling sharply after reporting worse-than-expected second-quarter results. 😩

Its loss per share of $1.10 was above the $0.98 loss expected. And revenues of $400 million fell short of the $416 million expected. 🔻

More importantly, Founder and CEO Max Levchin announced that the company would cut 19% of its workforce. The firm hired ahead of the revenue required to support the size of the team, using its pandemic-era growth to justify the strategy. However, that all changed when interest rates began rising in mid-2022. He says the Fed’s actions“dampened consumer spending and increased the company’s cost of borrowing dramatically.”

Like other technology CEOs, he says the responsibility falls on him, noting, “The root cause of where we are today is that I acted too slowly as these macroeconomic changes unfolded.”

Moving forward, he expects Affirm’s headcount to be flat for the foreseeable future. Additionally, the company is redirecting the majority of its R&D efforts to margin-improving projects, repeat consumer engagement and Debit+ for the next several quarters. Hopefully, those efforts can help stabilize its business in the current, more challenging environment.

$AFRM shares are down roughly 20% on the news as investors run for the exits. 🏃