PayPal reported fourth-quarter earnings and revenue that beat expectations. However, total payment volumes were lighter than expected. 🤷

The company’s adjusted earnings per share came in at $1.24 on $7.4 billion in revenue. Estimates were for $1.20 in earnings on $7.39 billion in revenue. Total payment volume processed rose 5% YoY to $357.4 billion, about 1% shy of the $360.38 billion expected.

For full-year 2023, executives expect earnings in the midpoint of its guidance at $4.87 per share. To the analyst community’s surprise, they did not provide revenue or total payment volume guidance. Consensus expectations are for full-year earnings of $4.79 per share, revenues of $29.89 billion, and total payment volume growth of 9.5% to $1.49 trillion.

Like other tech firms, the company recently laid off 7% of its workforce as it looks to cut costs. It also has a $15 billion share buyback program that’s still outstanding. ✂️

Lastly, PayPal announced that its CEO, Dan Schulman, will retire at the end of 2023. He became PayPal CEO in 2015 after its split from eBay but will remain a board of directors member after retiring. The company is currently searching for his successor.

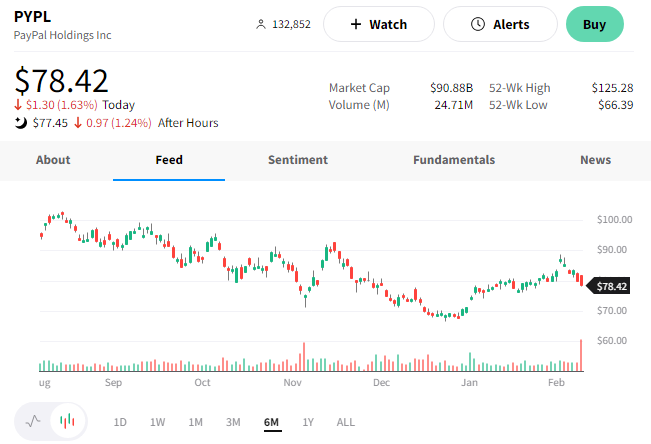

$PYPL shares initially rallied on the news but are sitting with a 2% loss after hours. 🔻