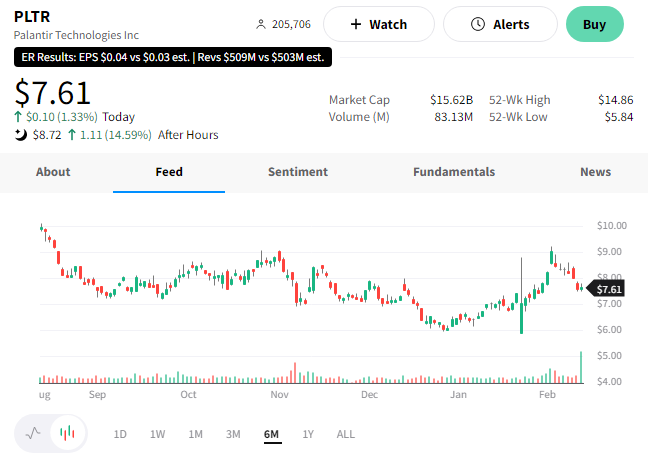

Retail-favorite Palantir Technologies is soaring after reporting its first-ever profitable quarter. 📝

Revenues of $509 million were up 18% YoY and topped estimates of $502.3 million. Driving the strong revenue number was $293 million in government sales (+23% YoY).

The company’s first-quarter and full-year revenue forecast fell below analyst expectations. 🔮

However, the company’s GAAP profitability was the star of the show, as it hadn’t expected to achieve that until 2025. Its focus on managing expenses and stock-based compensation helped it achieve sooner-than-expected profitability. That resulted in fourth-quarter earnings per share of $0.04, rising 100% YoY and beating the consensus $0.03 estimate.💰

Its Chief Executive Officer Alex Karp said, “Our commitment to and relentless focus on the long term at times has required patience. At other times, as our profitability demonstrates, we will deliver results at a rate that surpasses even the expectations of those who believed we would prevail.”

$PLTR shares were up 16% after hours. 📈