Walmart, Home Depot, and Target earnings have already sounded the alarm about the health of U.S. consumers. And today, Lowe’s and Lumber Liquidators added to the anxiety with their own earnings misses. 😨

Let’s take a look at what they said. 👀

First up is Lowe’s, which reported adjusted earnings per share of $2.28 vs. the $2.21 expected. Rising costs continued to pressure gross margins, which shrank to 32.3% in the quarter.

Revenues of $22.45 billion fell short of the $22.69 billion estimate. And if you account for the extra week that occurred during the fourth quarter, then sales actually declined YoY. 🔻

Same-store sales also fell 1.5%, with a 0.7% decline in the U.S. Like Home Depot, the company blamed a reduction in lumber prices for the drop. Overall, a 4.8% rise in average ticket prices was insufficient to offset a 5.5% decline in transaction volumes. 🛒

For fiscal 2023, executives expect total revenues of $88 to $90 billion and a flat or 2% decline in same-store sales. The conservative outlook came in below consensus estimates, as they cited similar economic challenges as their peers. Overall, weakness in consumer spending and the housing slowdown continue to weigh on Lowe’s results and the broader industry.

$LOW shares fell nearly 6% on the news. 📉

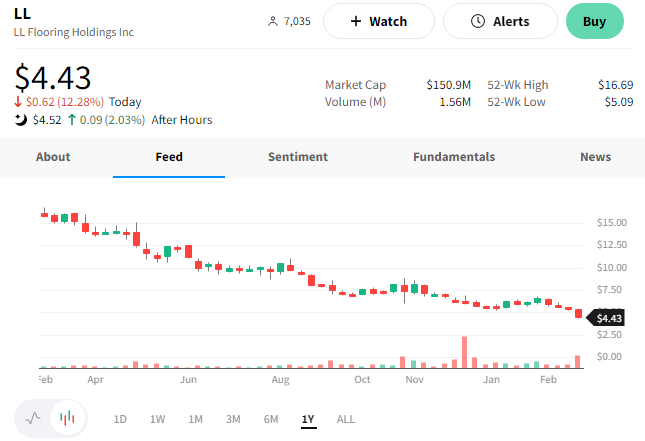

Meanwhile, Lumber Liquidators Flooring posted weaker-than-expected Q4 earnings. 🪵

Its adjusted loss per share of $0.29 vs. the expected $0.08 earnings per share. Meanwhile, revenues of $263.9 million also missed the $267.6 million expected. Total comparable store sales fell 9.5% YoY, and its gross margin fell to 35.9%. Operating margins also decreased by 10.40%, falling to -6.60%.

The company faces many of the same headwinds as Home Depot and Lowe’s. Growth in its pro customers helped partially offset the decline in consumer sales, but inflation and the more challenging macro environment are causing consumers to reduce their discretionary purchases. That, plus the housing slowdown, makes it a challenging environment for the company. 🏘️

$LL shares fell 12% on the day, nearing the all-time lows it set during the pandemic. 👎