The Brazilian airline Azul SA announced a new deal on aircraft leases amid a rosier outlook. ✈️

Investors were able to look past the airline’s wider-than-expected quarterly loss and ahead to potentially bluer skies. The company’s margins beat the consensus estimate, but more importantly, it secured a deal with its lessors.

The Sunday-night deal indicated that lessors responsible for 90% of its obligations had agreed to receive equity and tradeable debt in exchange for lower payments. A securities filing says the company anticipates it will be cash flow positive in 2024 and beyond because of the deal. It also plans to reduce its capital expenditures significantly in the years ahead. 🤝

Additionally, executives say the travel demand environment remains strong. They expect to generate a record $3.84 billion in revenue during 2023. That’s a 40% increase from pre-pandemic levels. 📈

While there remain risks in the company’s plan and overall operations, today’s news was a welcome sight. This deal and planned cost-cutting should give the airline enough runway to turn itself around.

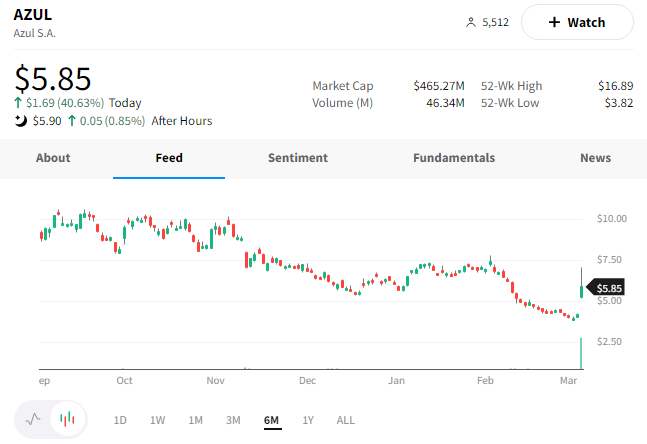

$AZUL shares recently hit all-time lows. But today, they had their best trading day ever, rising nearly 41% on the news. Optimism also spread to other Brazilian travel-related companies, with many of their shares popping double digits. 👍