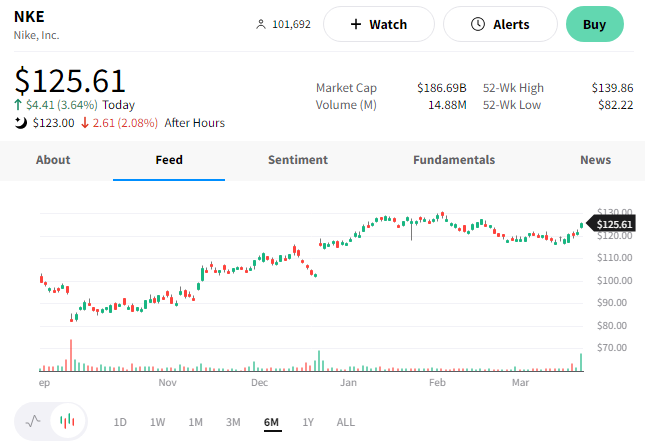

Nike shares popped, then dropped in extended hours after reporting a mixed holiday quarter.

The retailer’s adjusted earnings per share of $0.79 and revenues of $12.39 billion beat the expected $0.55 and $11.47 billion. 👍

As we discussed yesterday after Foot Locker’s earnings, Nike has made a strong push in its direct-to-consumer business. Last quarter, Nike Direct and Nike digital sales were up 17% and 20%, respectively. However, selling and administrative expenses were also up 15%, with wage-related expenses and Nike Direct costs rising. 🔺

Additionally, supply chain disruptions and changing consumer preferences left the company with a glut of inventory. As a result, it needed to discount heavily to offload some of that excess, which weighed on margins. Gross margins fell 3.3% to 43.3% in the quarter, though Nike CEO John Donahoe said the company is now past its inventory peak. 📦

The 16% YoY increase in inventories reported this quarter was primarily due to higher product input costs and freight expenses.

In January, Nike’s leadership discussed the importance of an omnichannel approach. Its renewed partnership with Foot Locker and other wholesalers will continue to play a vital role in its sales and customer experience. Sales in that channel were down 7% QoQ to 12% but played an important role in the company liquidating some of its inventory. 🏬

Overall, investors remain concerned about the rising costs of its direct business and the slowdown in China’s market. Sales in that region missed the $2.09 billion expected by analysts, coming in at $1.99 billion. The weaker macroeconomic conditions and a slowdown in consumer spending here in the U.S. and internationally will remain a headwind for the retailer and its competitors.

The mixed messaging had $NKE shares flailing after hours. They’re currently down about 2%. 👎