CarMax was the best-performing stock in the S&P 500 today after better-than-expected results. 😮

Its adjusted earnings per share of $0.44 was higher than the expected $0.20 but less than half the $0.98 it earned last year.

The auto retailer’s profit per vehicle rose $82 from a year ago to $2,277. Strength in this metric helped offset falling transaction volumes and used-car prices. The average selling price of a used car fell 9.3% YoY, or about $2,700. As a result, the company’s net sales came in softer than the $6.08 billion consensus view at $5.72 billion. 🔻

Executives say that prices have begun to stabilize across the industry after falling for most of 2022. However, elevated inflation, higher interest rates, tighter borrowing standards, and a cautious economic outlook are weighing on demand.

With that said, management reaffirmed its long-term financial targets. It expects to increase its U.S. market share of used cars up to 10 years old from 4% to 5% in the 2025 calendar year. And it’s looking to sell as many as 2.4 million vehicles through its retail and wholesale channels by fiscal 2026. 🎯

Some analysts say the company is well positioned for the lower-unit volume and higher transaction price environment we’re currently in. Meanwhile, lower-margin transaction competitors like Carvana are struggling to stay afloat after swiftly building out their businesses during the pandemic. Their focus on growth has left them in a precarious position during the recent slowdown.

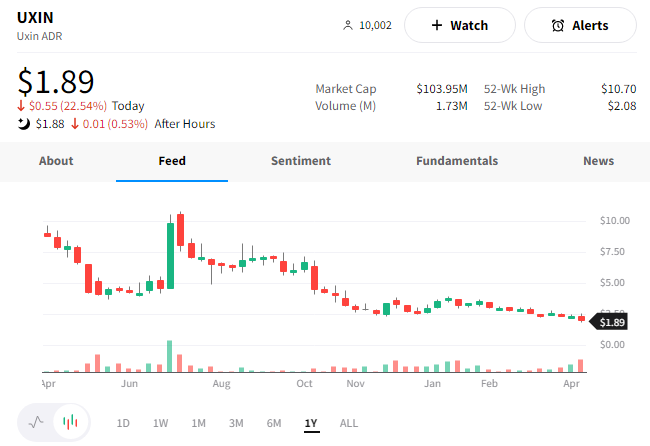

$KMX shares rose more than 10% on the news. 📈

China’s leading e-commerce platform for buying and selling used cars did not fare as well. 😬

Here are some key stats from Uxin’s unaudited Q3 financial results:

- Total revenues fell 24% YoY to $68.2 million.

- Transaction volumes rose 0.7% YoY to 4,987.

- Retail transaction volumes rose 76.7% YoY to 2,928 units.

- Gross margin of 0.6% was down from 4.1% last year.

- Loss from operations rose 33% YoY.

- Non-GAAP adjusted loss from operations rose 25% YoY.

Since the company has incurred losses from operations since its inception, it also talked about the actions it’s taking to improve its liquidity. It’s taken several steps in the past quarter and year to bring in cash and is still actively seeking new external financing. 💰

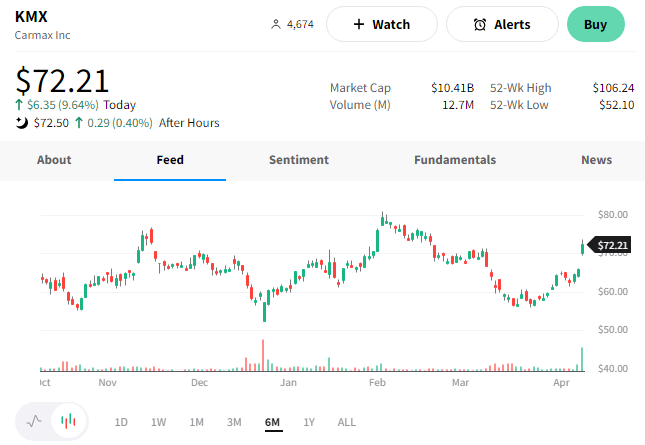

$UXIN shares fell 23% to all-time lows on the news. 📉