Shareholders took up arms today after Canada Goose Holdings reported fourth-quarter results. 😠

The winter clothing manufacturer, famous for its puffy luxury jackets, topped estimates but shared a cautious outlook.

Starting with the positives, adjusted earnings per share of C$0.14 doubled analysts’ estimate. Revenue also jumped to C$293.2 million, above the C$258.5 million expected. Driving those results were strong growth from the Asia Pacific region. However, European and Middle East growth of 65.4% and 27.3% also played a significant role. 🌏

While investors were happy to see a strong rebound in China and Europe / Canada staying resilient, they remain concerned about U.S. demand. Executives share that concern, with CFO Jonathan Sinclair saying, “We’re not being super ambitious for this year in the U.S…the market is going to be a bit more challenging in the U.S. because of the macroeconomics.”⚠️

Executives cited improving momentum in North America early in the current quarter. However, their first-quarter earnings and revenue estimates did come in below analyst expectations. With that said, they expect strength in other regions to accelerate throughout the year as their full-year fiscal-2024 earnings and revenue forecasts both topped estimates.

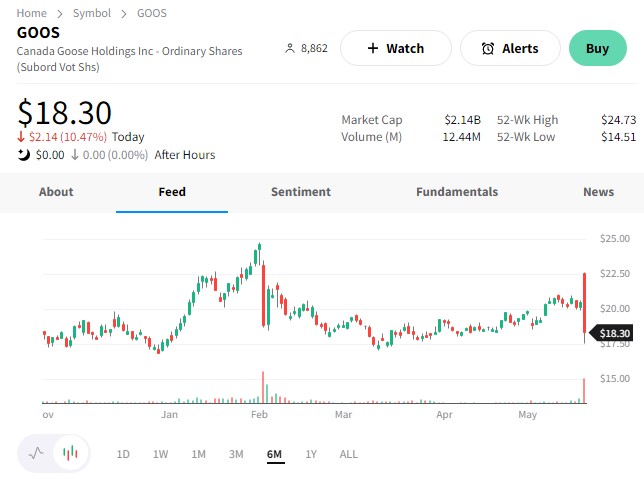

$GOOS shares initially jumped 10% at the open but faded throughout the day to close down 15%. Investors remain frustrated with performance as the company treads water near its IPO price from early 2017. 🙃

Meanwhile, fellow Canadian company and point-of-sale system / e-commerce software provider Lightspeed Commerce also fell 13% today. Executives expect lower revenue growth and higher costs in fiscal 2024 as they launch a new unified payment and point-of-sale system. 💳

Both results add to the many “cautious” outlooks about the U.S. consumer we’ve heard so far this earnings season. We’ll have to wait and see if that balance changes going forward.