America’s largest retailer did what Home Depot and Target couldn’t…beat Wall Street’s expectations.

Walmart reported adjusted earnings per share (EPS) of $1.47 on revenues of $152.3 billion. That topped the expected $1.32 and $148.76 billion. 💪

As for what’s driving that strength? Groceries and essentials. Nearly 60% of its annual U.S. sales come from groceries. And although that weighs on the company’s gross margins, its “always low prices” keep cash-strapped consumers returning. 🥑

Same-store sales excluding fuel rose 7.4% YoY at Walmart U.S., rising 7% YoY at Sam’s Club. Meanwhile, those brands saw e-commerce sales jump 27% and 19%, respectively.

Despite the solid overall results, executives said spending trends weakened as the quarter progressed. Persistently high prices on everyday items are leaving consumers with less discretionary income. And although consumers are still buying higher-margin merchandise, they typically wait for sales to do so. They’re also trading down to smaller pack sizes. 📉

Overall, economic indicators suggest a strain on the consumer, but their resilience has surprised Walmart execs. They believe that’s in part due to healthy consumer balance sheets. That said, stubborn inflation is a key factor contributing to executives’ uncertainty about the year’s second half. 📆

Despite those factors, Walmart held its fiscal-year earnings firm while raising revenue guidance. It’s expecting a 3.5% increase in consolidated net sales and adjusted EPS of $6.10 to $6.20, both in line with expectations. However, its second-quarter forecast did fall just shy of analysts’ view.

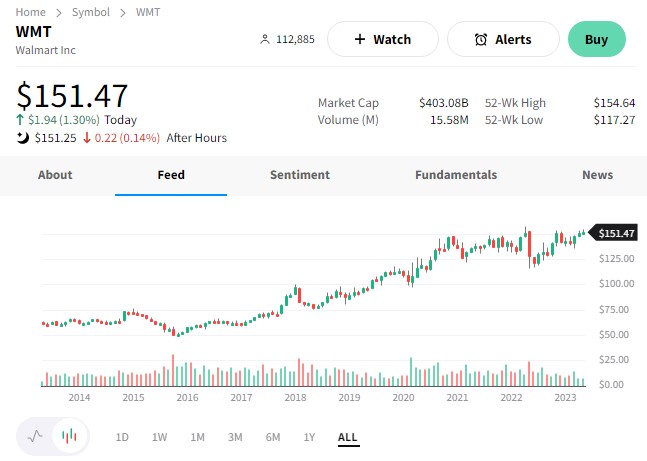

Investors took the mixed messaging in stride. $WMT shares rose 1%, just below all-time highs. 🔺

The cautious tones about the U.S. consumer continue. Whether it’s the biggest players like Walmart or a small mall-based retailer, executives are concerned that consumers will eventually run out of ammunition. So far, that hasn’t been the case, but their expectations reflect that fear. 😩

On the flip side, stock market bulls argue if the U.S. economy holds up better than many anticipate…that could set us up for some significant upside surprises in the back half of the year. Time will tell…