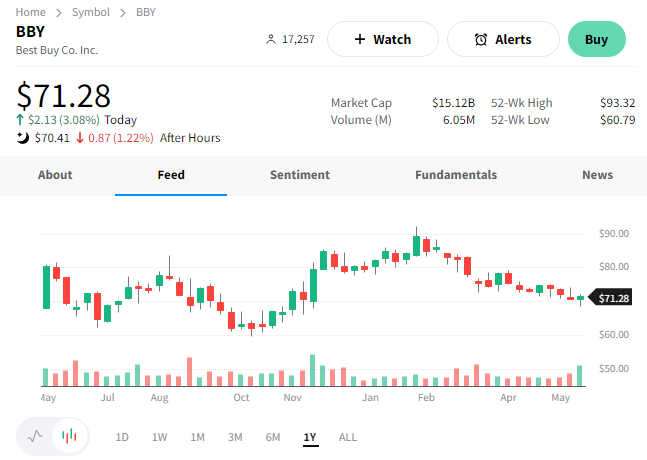

Best Buy shares remain roughly 50% off their pandemic-driven 2021 highs. Much of that has been driven by a slowdown in spending on discretionary goods like computers and household appliances. Although those factors offered a skewed perspective, we can still consider the consumer electronics retailer as a partial measure of consumers’ health. 🧭

In the first quarter, the company reported adjusted earnings per share of $1.15 on revenues of $9.47 billion. That was mixed vs. the $1.11 and $9.52 billion expected. Comparable sales fell 10.1%, also in line with expectations.

As we’ve heard from almost every retailer so far, consumers continue to spend more on necessities. And when they’re making discretionary purchases, it tends to be experiences rather than goods. Best Buy CEO Corie Barry reaffirmed that theme: “We’ve been seeing a consumer who is — whether or not you call it a recession — exhibiting some recessionary behaviors.” ⚠️

As a result, Best Buy reaffirmed the outlook it provided in March. It’s expecting full-year revenue of $43.8 to $45.2 billion, with a comparable sales decline of 3% to 6%.

With that said, the company is not taking this slowdown lying down. Below are several initiatives it’s been working on. ⚔️

- Growing online sales to a third of total revenue

- Cutting costs by shaking up its workforce and store footprint

- Revamping its membership program to help diversify its revenue and boost spending

- Diversifying its business away from solely consumer electronics, partnering with Atrium Health to sell devices and handle the installation of home hospital care equipment

With shares trading at roughly the same level as a year ago, it appears investors are looking past the current challenges and ahead to the future. As a result, $BBY shares were up about 3% despite the lackluster results. 👍