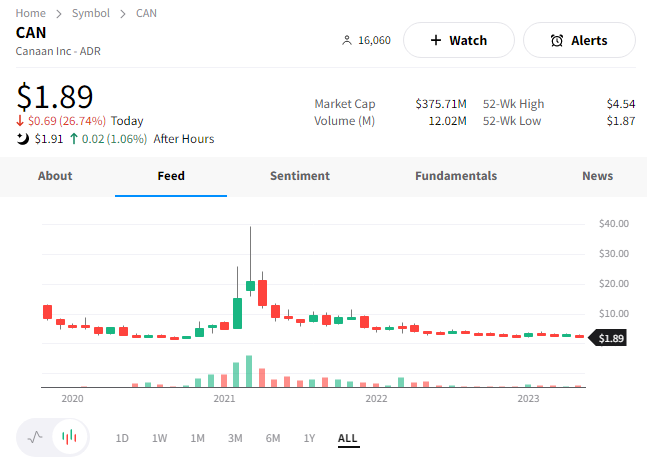

Pinduoduo, now known as PDD Holdings, is rebounding from nearly seven-month lows following better-than-expected results. 👍

The company’s adjusted earnings per American depository share (ADS) of RMB6.92 was well above the RMB4.46 expected. Its gross margin also improved from 69.9% to 70.4%.

Meanwhile, revenues grew 58.1% YOY to RMB37.64 billion, topping the consensus view of RMB32.18 billion. That’s broken down into online marketing services of RMB27.24 billion (+50% YoY) and transaction services of RMB5.59 billion (+86% YoY). 💰

Executives say their cost-cutting efforts and operational prioritization have been paying dividends. Additionally, recovery trends among consumers continue to improve, with online retail picking up steam and users showing a higher willingness to shop. Overall, these early trends should lay a “solid foundation” for steady consumption growth throughout the year. 🛒

To position itself to benefit from this improvement, it’s investing heavily in promoting ecosystem vibrancy and sustainability. Its dedicated ’10 Billion Ecosystem Initiative’ is designed to facilitate an environment where quality merchants can flourish. In addition, improving cash flows and operating profitability should also extend the company’s runway for investing in its growth goals.

Despite today’s 19% rally, $PDD shares are roughly 65% off their 2021 highs. Nonetheless, investors seem hopeful that the company’s efforts will continue to push the stock in the right direction. 🔺

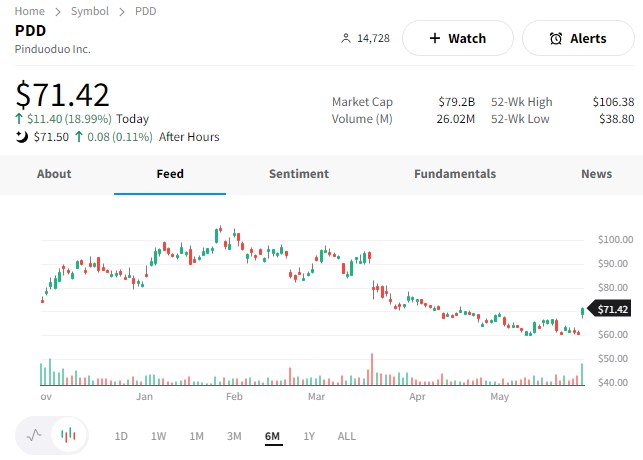

While discussing Chinese stocks, it’s worth mentioning Canaan Inc. The China-based computer hardware manufacturer is plunging after reporting weak results. 😮

The computing solutions provider reported an adjusted net loss of $3.37 per share. Last year it reported a $2.52 per share profit. Revenues also dropped from $201.8 million to $55.2 million, missing the consensus view of $62.4 million.

Executives blamed an industry-wide reduction in selling prices. They also noted unforeseen delays in payments and shipments following U.S. regional bank failures. However, investors remain skeptical of that reasoning given the company’s many quarters of underperformance. They want fewer excuses and more results. 😑

$CAN shares were down another 27% today, approaching their all-time lows.