Let’s talk about old man Hewlett Packard’s two publicly-traded entities and their earnings from after the bell. 🔔

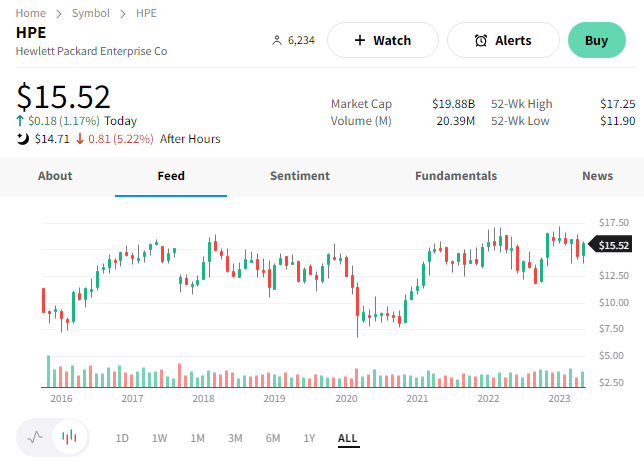

First, we’ll start with HP Inc, which trades under the ticker HPQ. This part of the company comprises three reportable segments: personal systems, printing, and corporate investments. It also retained the company’s original ticker and trading symbol upon the split in 2015. 🖖

It reported second-quarter adjusted earnings per share of $1.07 and revenues of $12.9 billion. That was mixed vs. the consensus estimate for $0.76 per share on $13.07 billion in revenue.

Given the slowdown in the personal computer (PC) market and overall discretionary spending, executives remain focused on cost-cutting efforts. However, like Best Buy and other retailers, they hinted that they expect a rebound in PC sales during the year’s second half and into 2024. 📆

Analysts were encouraged by cost-cutting, increasing bottom-line guidance, and inventory reduction. However, the company did not receive the same artificial intelligence (AI)-fueled boost that others in the market did. Executives tried to spur excitement by saying AI represents a “tremendous refresh opportunity to redefine what PCs can do.”

Clearly, investors remain skeptical about the overall impact AI will have on its business. $HPQ shares traded down about 4% after hours. 🔻

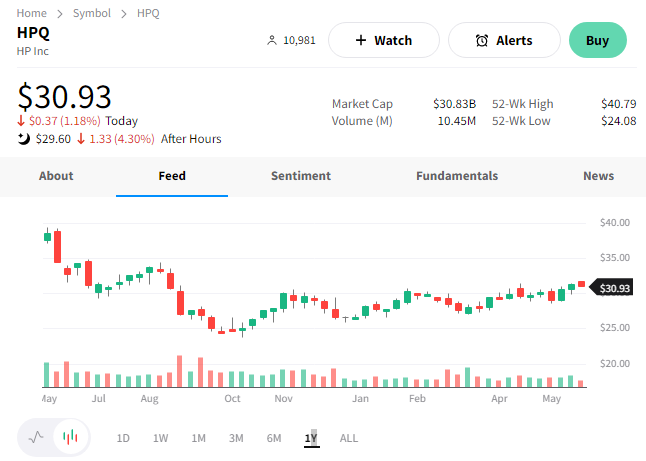

Hewlett Packard Enterprise Co. trades under the ticker symbol HPE and did not fare better. 👎

The global edge-to-edge cloud company reported adjusted earnings per share of $0.52 on revenues of $6.97 billion. That was mixed compared to the $0.49 and $7.3 billion anticipated by analysts. Despite the shortfall, executives focused on the shift towards higher-margin revenue streams like AI (+18% YoY) and its Intelligent Edge segment ($1.3 billion).

Its third-quarter revenue guidance of $6.7 to $7.2 billion was also lighter than the $7.2 billion consensus view. And its earnings per share estimate of $0.44 to $0.48 straddled the $0.46 expected.

$HPE shares traded down about 5% on the news. 📉