Technology consulting firm Accenture is falling again today despite better-than-expected quarterly results. ☹️

Its adjusted third-quarter earnings per share of $3.19 came on $16.56 billion in revenue. Those topped the $3.01 and $16.49 billion expected. However, its outlook is where things fell apart.

Executives lowered their fiscal 2023 revenue growth range from 8%-10% to 8%-9%. They also anticipate current-quarter revenue of $15.75 to $16.35 billion, which trailed the $16.35 billion consensus estimate.

They blamed weakness in the tech, media, and communication industries, where revenue fell 8% YoY in the recent quarter. The company’s largest market, North America, also saw revenue growth slow to a three-year low of 2%. 🔻

Unfortunately, artificial intelligence (AI) won’t give the company a boost anytime soon. Accenture CEO Julie Sweet said she doesn’t expect generative AI to be a significant growth driver next year. Instead, the firm is focused on companies finishing their migrations to the cloud, as there’s so much digital transformation work left to do in the market. 🤖

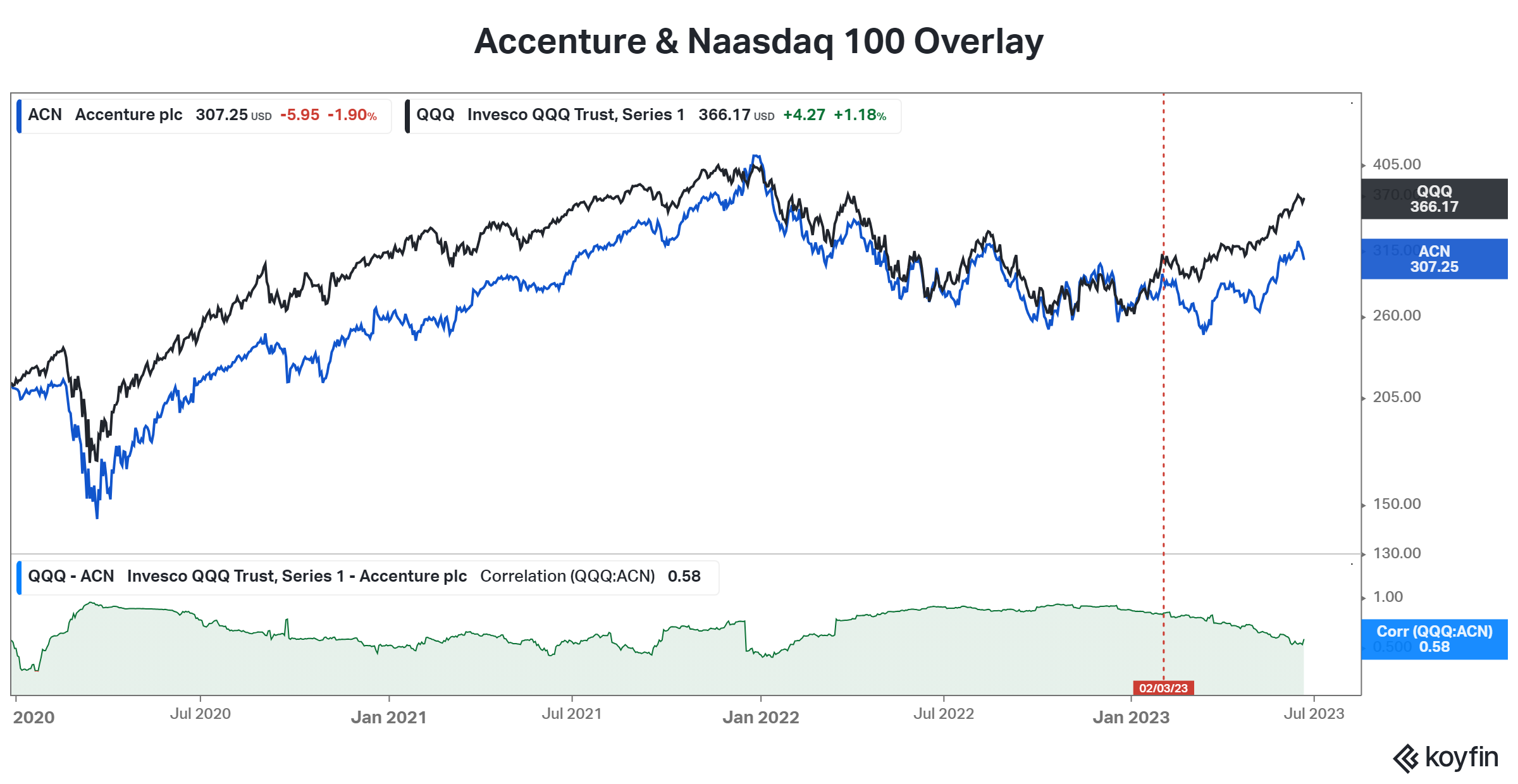

Clearly, investors are concerned about a continued slowdown in tech spending. However…what’s interesting is the divergence that’s formed between $ACN shares and the tech-heavy Nasdaq 100 ETF $QQQ.

Below is an overlay chart showing a strong positive correlation since early 2020. However, that relationship broke down in February and has since seen Accenture lag the broader tech sector. Part of that could be explained by the largest five or ten tech stocks pulling the Nasdaq 100 higher.

Nonetheless, it’s an interesting relationship to keep an eye on as it begs whether the market is too optimistic about tech as a whole. Or if Accenture and other service providers to the industry are being too cautious. We’ll have to wait and see. 🤷