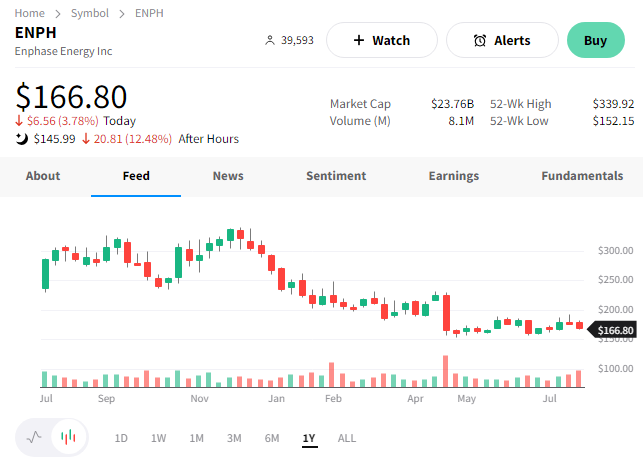

Enphase Energy develops and manufactures solar micro-inverters, battery energy storage, and EV charging stations for residential customers. However, today the only thing it produced was losses for its shareholders. 😬

The company reported adjusted earnings per share of $1.47, which topped the $1.28 expected. Revenues fell short, though, at $711.1 million vs. the $726 million consensus view. 🔻

Executives expect third-quarter revenues of $555 to $600 million. That was well shy of the $749 million Wall Street expected.

The revenue miss and weak guidance were enough to send $ENPH shares down another 13% after hours. 📉

Meanwhile, competitor First Solar jumped after beating both revenue and earnings expectations. $FSLR shares jumped 8% toward the 15-year highs set earlier this year. 🌞