While investors remain focused on the technology sector, industrials and other cyclical stocks continue to break out. The big question remains whether the economy will perform as the consensus “soft landing” view believes. But the market is certainly positioning itself as if it will. 🤔

Check out the popular long-term treasury ETF $TLT hitting fresh year-to-date lows today. Although the Fed Fund Futures market still isn’t pricing in another hike before the end of the year, the rest of the bond market seems to be getting comfortable with the fact that rates may need to head higher (and stay there longer).

After nine months of consolidating, some traders believe this chart signals the start of U.S. interest rates next leg higher. 📈

Meanwhile, industrial giant Caterpillar ($CAT) soared 9% to all-time highs following earnings. 🐛

The company topped expectations, reporting adjusted earnings per share of $5.55 on revenues of $17.3 billion. Analysts had expected $4.57 per share on $16.5 billion in revenues. Executives saw strength across all three of their construction, mining, and energy-related businesses, with profit margins improving from 13.8% to 21.3% YoY. 🔺

For as much as the headlines say investors are anticipating a recession and a slowing economy, they’re certainly not investing like that. Today’s breakout in Caterpillar is certainly putting the recent strength in cyclical stocks back on everyone’s radars.

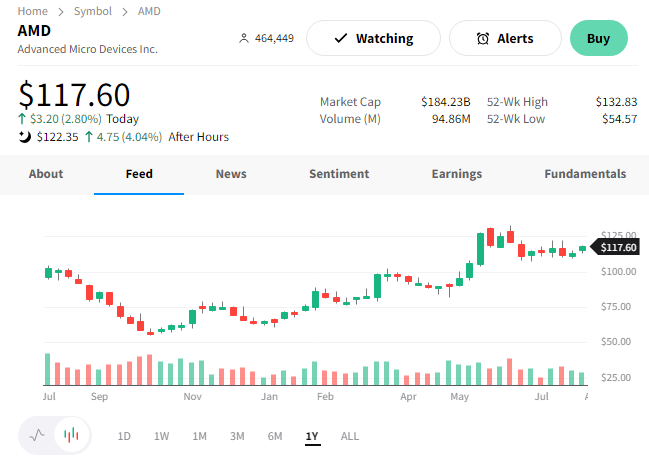

And over in technology land, Advanced Micro Devices reported slightly better results. 👍

The semiconductor company reported adjusted earnings per share of $0.58, topping estimates by $0.01. Revenues of $5.36 billion also exceeded the $5.30 billion consensus view.

With client PC business, data-center, and gaming business units revenue all down YoY, the company is looking ahead to artificial intelligence (AI) opportunities. Similar to its peers, the focus on higher-end chips remains as the PC and gaming market supply vs. demand dynamics rebalance. 🤖

$AMD shares rose above 4% after the bell.