The last bit of mega-cap tech earnings is rolling in, with the big A’s setting the market’s tone for tomorrow. Let’s see how they performed. 👀

Starting with Apple, the company’s quarter was mixed and received a muted reaction.

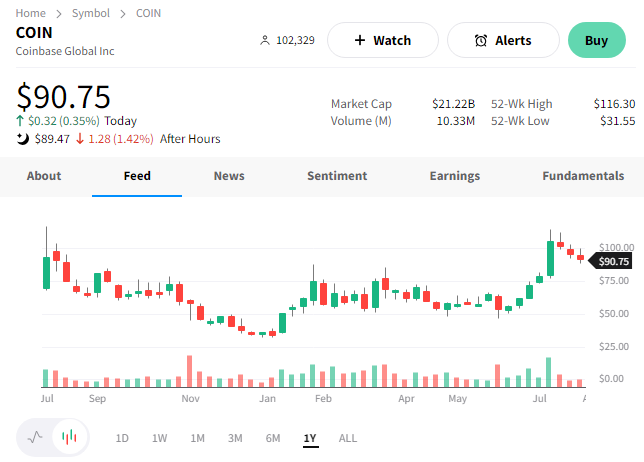

Here is CNBC’s summary chart of the numbers:

Investors were thrilled to see services revenue grow at 8% YoY vs. the 5% YoY expected. However, weaker-than-expected iPhone revenue led to the company’s third consecutive quarter of YoY total revenue declines (albeit marginally). 🔻

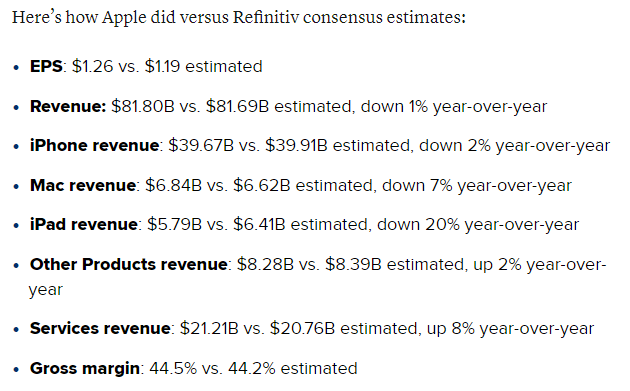

$AAPL shares were down about 3% after the bell, pulling back from all-time highs.

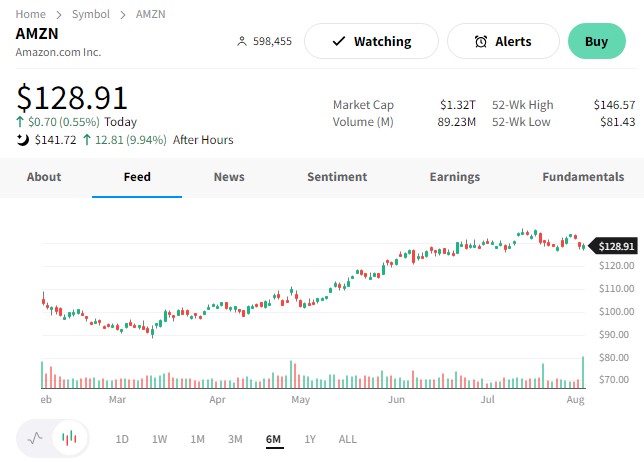

Amazon was up next and received a much better reaction. 🤩

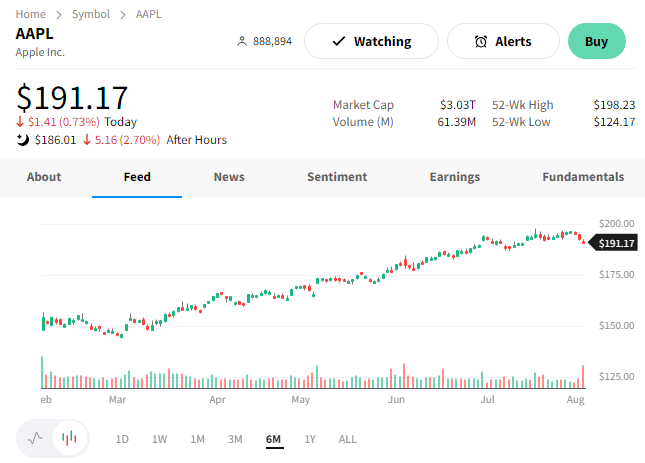

The company’s earnings and revenue topped estimates, driven by strength in Amazon Web Services (AWS) and continued growth in advertising. It returned to double-digit revenue growth after being stuck in the single digits for five of the past six quarters.

Here’s a quick summary.

Looking ahead, the company expects revenues of $138 to $143 billion. That represents 9% to 13% growth and topped analyst estimates of $138.25 billion. 🔺

$AMZN shares jumped 10% to nearly one-year highs after hours. 📈

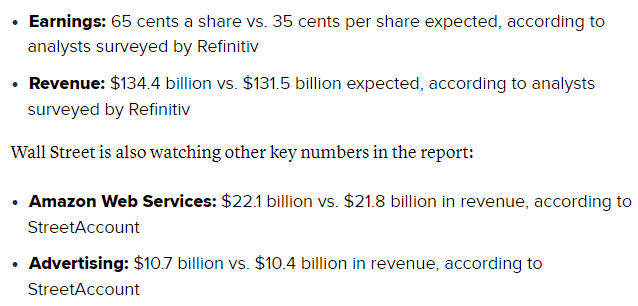

And lastly, we need to mention Coinbase, which initially popped and dropped after its report. ₿

The crypto exchange’s net loss per share narrowed to $0.42. Revenues declined 12% to $707.9 million, topping estimates of $6631.2 million.

Like other brokers, higher interest income is driving revenues more than transaction-based fees. However, it fell QoQ to $201.4 million after circulation of the USDC stablecoin declined amid regulatory pressure related to staking. 💰

Similar to Robinhood, investors remain concerned about whether the business can diversify its revenue sources enough to sustain it over the long term. That, an uncertain regulatory environment, and a stock that’s rallied significantly since January has some investors stepping back until there’s more clarity.

$COIN shares are down about 1% after the bell. 🤷