Investors were left with mixed feelings after Disney reported earnings that sent shares down then up after hours 🙃

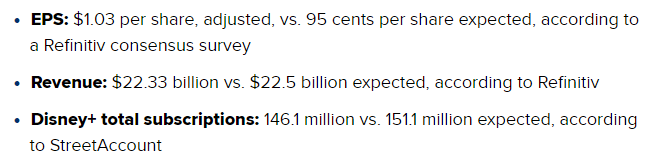

Below is a recap of the key figures analysts were watching:

The company continues to restructure into three core businesses: film studios, parks, and streaming, which will all be linked to its brands and franchises. $2.65 billion in one-time charges and impairments caused a quarterly net loss. However, adjusted earnings per share of $1.03 topped expectations. ✂️

On the revenue side, a 4% YoY increase was slightly lower than forecasted. Disney Parks, Experiences, and Products revenue jumped 13% YoY, while Media and Entertainment Distribution fell 1% YoY.

Revenues from its Direct-to-Consumer (streaming business) jumped 9% YoY. That partially offset Linear Networks -7% YoY, Content Sales/Licensing and other -1% YoY, and Intrasegment Revenue Eliminations -18% YoY. 🔻

On the streaming side, a 7.4% QoQ decline in Disney+ subscribers was larger than Wall Street anticipated. Most of those losses came from Disney+ Hotsar, which fell 24% Yoy after losing rights to Indian Premier League cricket matches. 📺

To further monetize its streaming business and stem losses, the company is raising the price of its ad-free streaming tier in October. It’s also cracking down on password sharing, as the trend Netflix started begins to take hold in the industry. 🔺

Overall, there remains much uncertainty about the company’s turnaround plan. As a result, $DIS shares continue to hang out near nine-year lows as investors assess the struggling conglomerate’s prospects. 🔮