It was another mixed day of retailer earnings, with several outsized moves to discuss. 👇

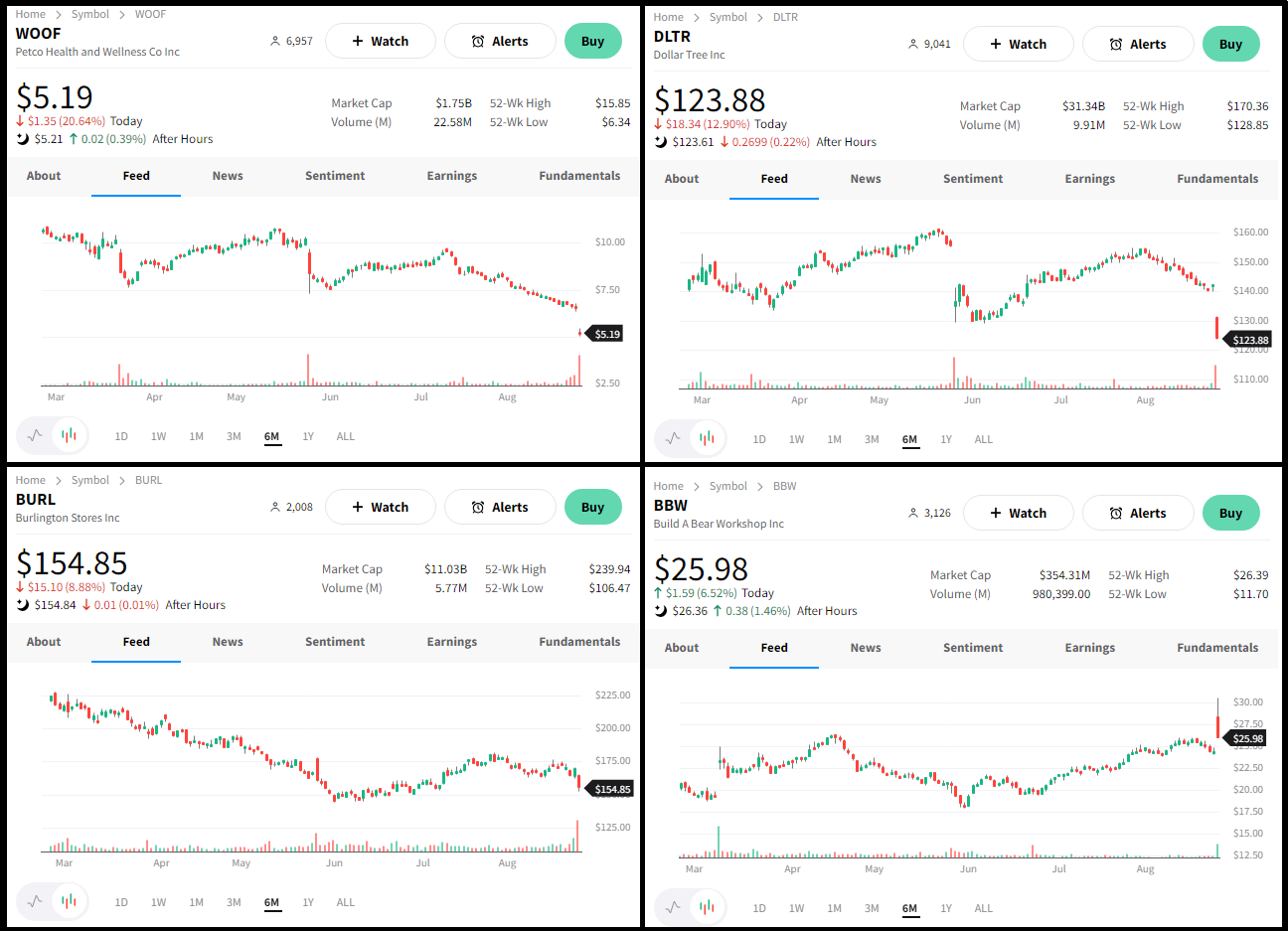

Dollar Tree shares tumbled as the consumer trend of spending mostly on food and essentials, pressuring margins at the discount retailer. Its earnings and revenues topped expectations, with same-store sales climbing 6.9% across the company. However, executives cut full-year revenue and earnings guidance, citing those consumer trends and challenges with shrink. $DLTR shares fell 13% on the day. 💵

Burlington Stores also fell sharply after saying its core customer is under pressure. CEO Michael O’Sullivan said, “Looking at the spring season as a whole, it is clear that the lower-income shopper, our core customer, is still under significant economic pressure.” Current quarter results topped estimates, as did margin improvements. However, investors are looking ahead to the challenges, sending $BURL shares down 9%. 👚

Petco Health & Wellness fell to all-time lows after saying discretionary spending at its stores continues to fall. Its earnings and net revenue topped expectations, but its supplies and companion-animal business saw an unexpected 9.4% YoY revenue decline. That, combined with concerns over its gross margin decline, caused the company and analysts to reduce their forecasts. $WOOF shares plunged 21% on the day. 🐕

On a positive note, Build-A-Bear Workshop soared to 16-year highs after reporting better-than-expected results. The retailer continues to pare down its revenues, driving gross profits up and seeing 8.5% YoY sales growth that topped analyst estimates. Executives believe the momentum should continue, expecting full-year 2023 revenues to rise 5% to 7% as the company continues expanding. $BBW shares were up big on the day, ultimately closing up nearly 7%. 🧸

While it reported results after the bell yesterday, retailer Guess surged today as investors digested the news. Its adjusted earnings per share and YoY revenue growth of 3% topped estimates, driven by strong revenue growth in Europe (+9%) and Asia (+19%). That offset weakness in its U.S. retail and wholesale businesses. $GES shares rose 26%, approaching their year-to-date highs. 👕

Retail pharmacy chain Walgreens continues its plunge today, falling to 14-year lows. CVS came under pressure, too, despite announcing a push into cheaper versions of complex drugs. 🏪

And lastly, Nordstrom and Gap fell after reporting mixed results of their own after the bell. 🔔