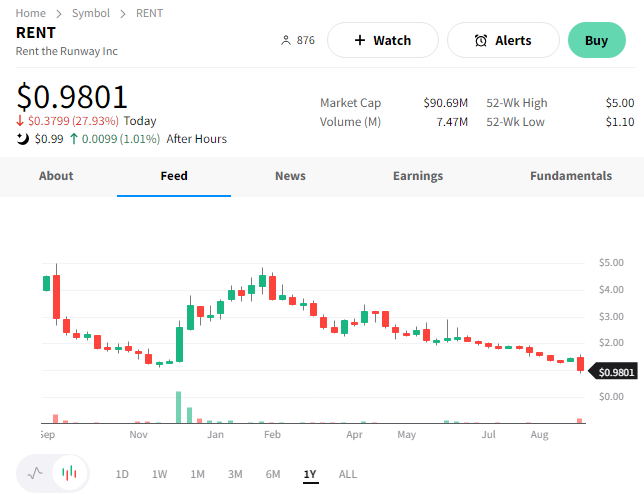

Investors in subscription fashion service Rent The Runway probably wish they rented shares instead of buying them. That’s because shares fell to fresh all-time lows after another weak quarter. 🙃

Its second-quarter loss per share of $0.40 matched analysts expectations. Meanwhile, a 1% YoY revenue decline to $75.7 million missed the $78.1 million expected.

Ending active subscribers jumped 11% YoY to 137,566, total subscribers rose 6% YoY to 184,400, and gross margin improved by 150 bps YoY to 43.9%. 🔺

With demand remaining weak, the company continues to focus on operating efficiencies, inventory control, and improving its site and onboarding experience.

As a result, executives expect fiscal 2023 revenues to be flat YoY at $296.4 million, adjusted EBITDA margin of 7% to 8%, and free cash flow of negative $50 to $53 million. 🔮

$RENT shares fell 28% to their lowest level as a public company. 👎