It’s been a rough month for Barnes Group, which is down over 40% in October. Most of those losses came today after it reported weaker-than-expected quarterly results. 📉

The engineered products, industrial technologies, and solutions provider generated adjusted earnings per share of $0.19, well below the $0.48 expected. Revenues jumped 15% YoY to $361 million, while analysts anticipated $364.2 million. 🔻

Executives lowered their 2023 outlook, forecasting organic sales growth of 5%-6% and adjusted earnings per share of $1.57-$1.67. Previous guidance was for 7%-9% and $2.15 to $2.30. They cited the financial impacts of its MB Aerospace acquisition and a reduced industrial forecast.

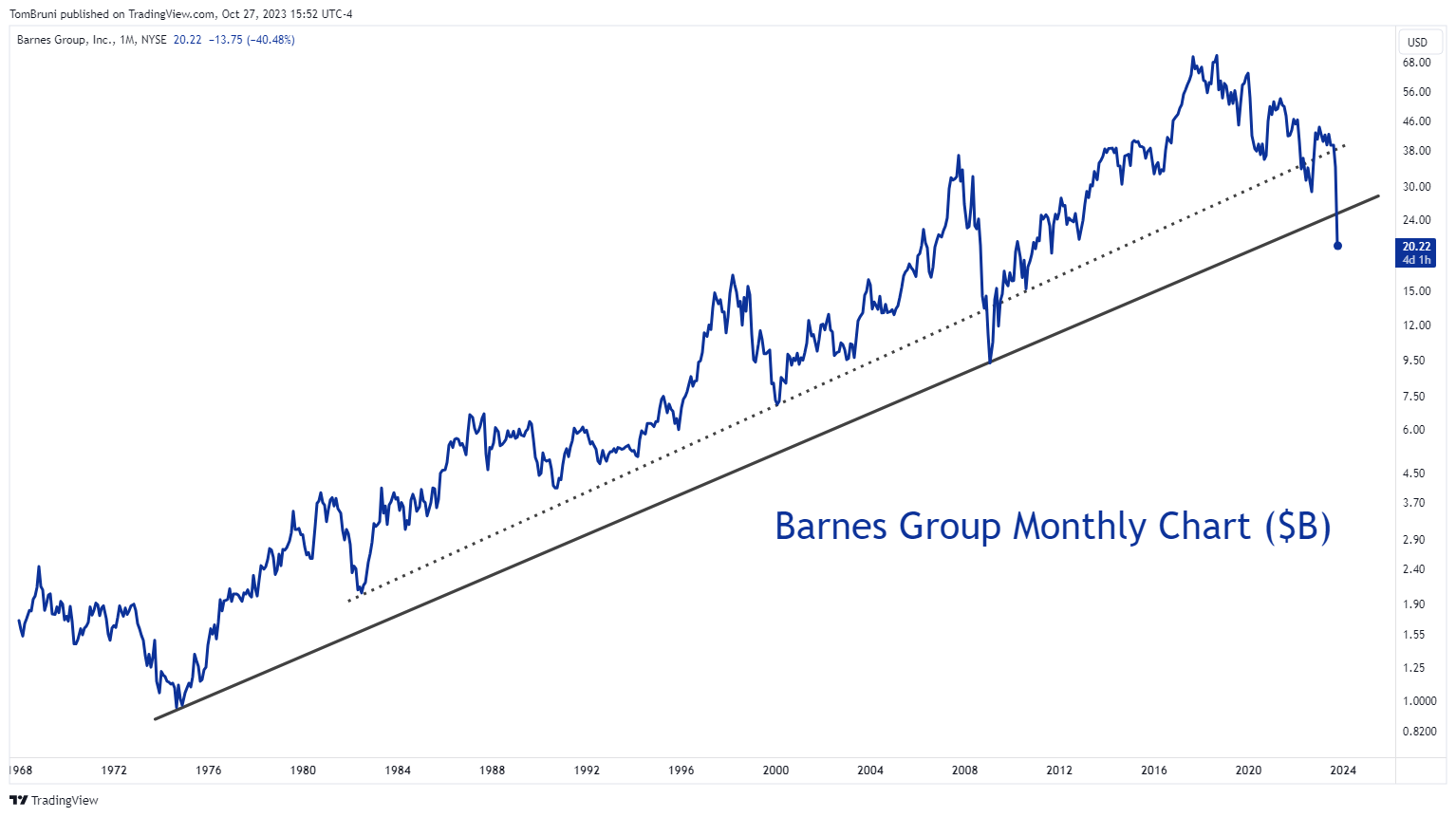

$B shares plunged 33% today, with investors saying its long-term chart has now clearly broken its uptrend that’s been intact for decades. The market is waiting for a clear catalyst that’s going to stem the stock’s decline. But so far, there hasn’t been anything notable to entice buyers. 🤷