Investors got an update on the energy sector today from oil and gas giants Exxon and Chevron, which both reported results. 🛢️

Exxon Mobil reported adjusted earnings per share of $2.27 on revenues of $90.8 billion. Both were below expectations of $2.37 and $93.4 billion, with weakness in its refining and chemicals segments driving the miss. 🔻

The company also expects to spend more on capital projects than analysts anticipated, saying it’ll come in at the top of its $23 to $25 billion range this year. However, to entice investors, the company is putting more of its cash to work by increasing its quarterly dividend from $0.91 to $0.95. That represents a 3.6% yield at current levels. 💸

Meanwhile, Chevron’s $3.05 per share in earnings on revenues of $51.9 billion were mixed vs. the $3.70 and $51.4 billion expected. Weaker refining margins and natural gas prices weighed on the company’s results this quarter. Unlike Exxon, the company did not boost its dividend this quarter but told shareholders they could expect higher dividends as its free cash flow grows. ⛽

Both companies will also experience some earnings drag initially from their recent acquisitions. Exxon paid $59.5 billion to buy Pioneer Natural Resources and expand its presence in the Permian Basin. Meanwhile, Chevron purchased Hess for $53 billion to expand its production in oil-rich Guyana. But, they’re expected to be accretive to revenue and earnings long-term.

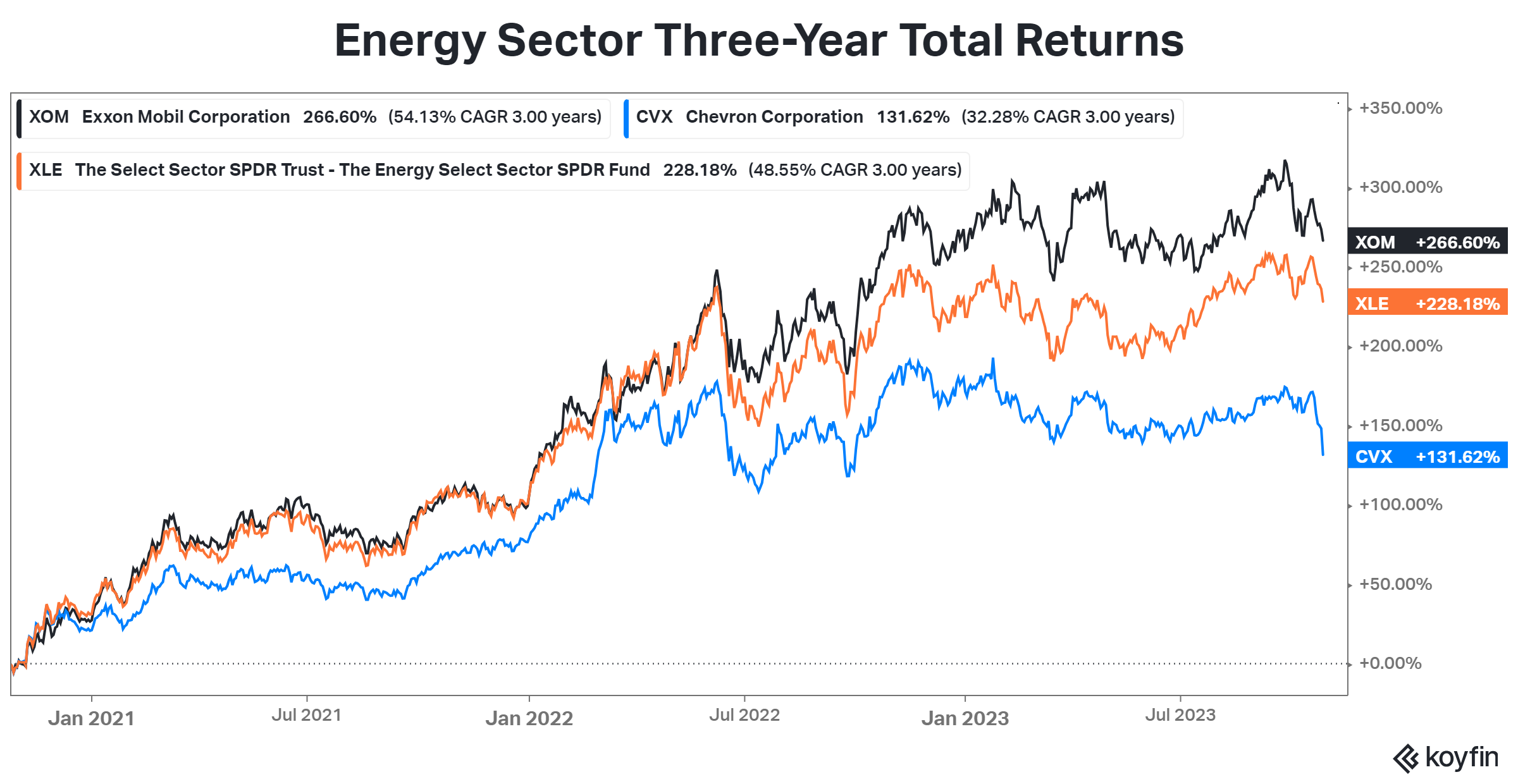

With U.S. oil producers trading at a major premium to their European peers, they’ll need a bit more than “higher oil prices” to go right for them to continue their strong runs from the last few years. So far, stock prices in the sector have been flat for the last year as fundamentals look to catch up to the massive gains experienced in 2021 and 2022. 📊