Apple is the latest tech giant to report results. But despite beating on most metrics, the stock is falling after hours. Let’s take a look at why. 👇

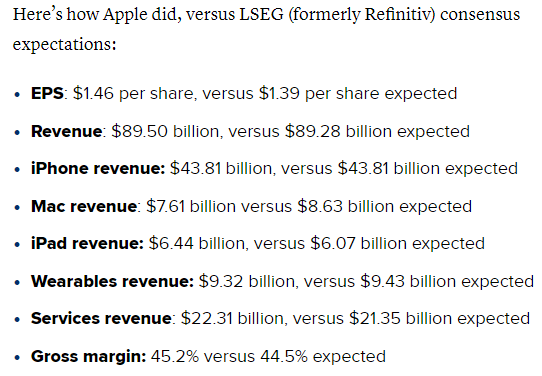

First, let’s start with this CNBC chart that summarizes actuals vs. estimates for the main metrics:

As we can see, the company topped earnings and revenue estimates, driven by strength in its iPhone and services businesses. Gross margin also expanded in the quarter, more than 70 bps above Wall Street’s outlook. However, the company’s Mac and Wearables divisions missed as discretionary spending on these items remains soft among consumers. 🔺

Within services, Tim Cook said that “every main service hit a record,” which is great to hear about its higher-margin business. It’s also sitting on a $162.1 billion cash pile, will pay a $0.24 per share dividend this month, and returned $25 billion to shareholders during the quarter by repurchasing shares and paying dividends. 💰

But things weren’t all great for the business. For example, the Greater China area (its third largest market) is seeing increased competition and revenues essentially flat YoY at $15.08 billion. Additionally, its Mac and iPad businesses remain under pressure vs. strong 2022 comparables. Analysts are unsure if the release of M3 chips and a product refresh will be enough to grow again. ⚠️

Looking ahead, the company did not provide formal guidance but expects total revenues to be flat YoY during its holiday quarter. Analysts had expected 4.5% YoY growth, though its gross profit margin and EBIT forecasts exceeded analyst expectations. Nonetheless, with the company experiencing its fourth straight quarter of YoY revenue declines, investors remain concerned about its ability to grow at its size and in the current economic environment. 😬

$AAPL shares initially popped but are now down about 3% after the bell as investors digest the news.