Two of our community’s favorite tech stocks are tumbling after hours, so let’s look at why. 👇

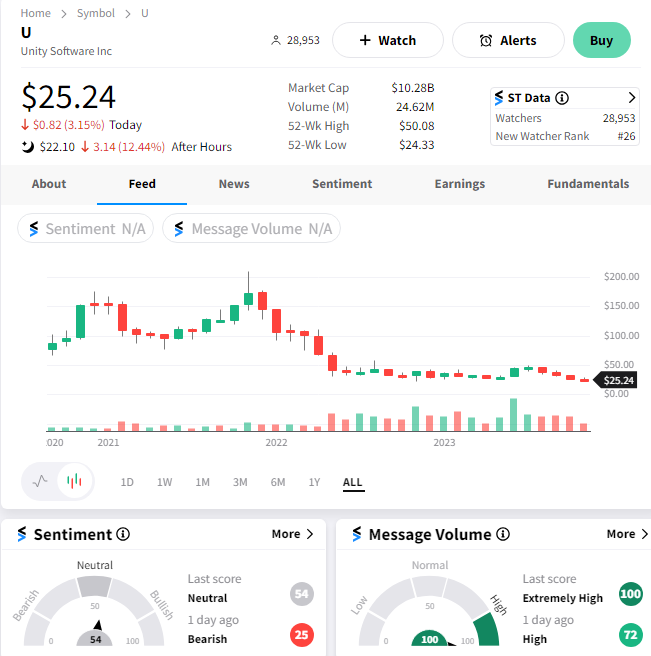

First up is video game engine developer Unity, which was recently in the news for pissing off literally everyone with its new pricing model. Shortly after that announcement, the backlash caused it to quickly change its plans and replace its CEO with former Red Hat CEO Jim Whitehurst.

Today’s messaging did little to quell investors’ anxiety. The company’s $0.32 per share loss on revenues of $544.2 million missed expectations. Its executive team said they did not expect the introduction of new fees to be easy but now see the change having minimal benefit until ramping in 2025. 🗓️

Management has struggled to determine how best to charge clients for its products but said they will implement a new plan this quarter. They noted that this may involve discontinuation, layoffs, and reduced office space. It appears the company is still figuring out all the details, as it declined to guide for the current quarter.

Nonetheless, significant changes are coming and should be finished by the end of the first quarter of 2024. $U shares fell another 12% after the bell, sitting at all-time lows. 📉

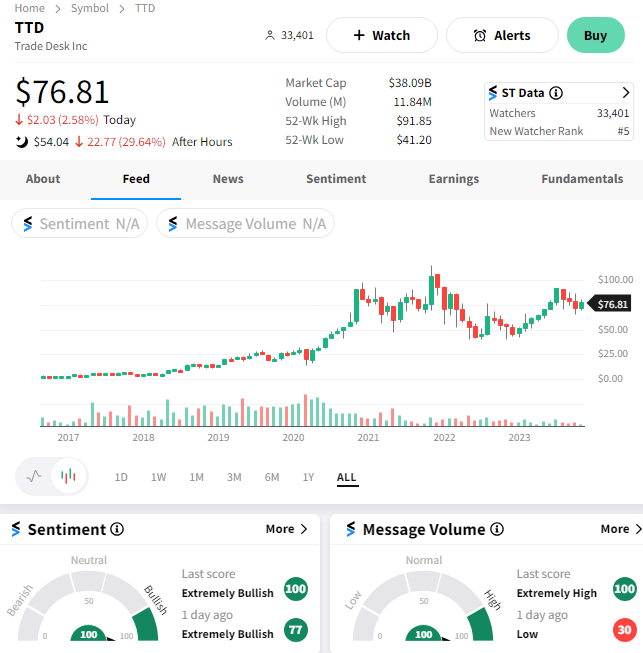

Next up, the marketing automation company Trade Desk is also taking a beating after hours. 😬

The company’s adjusted earnings per share of $0.33 and revenues of $493 million topped expectations of $0.29 and $487.04 million. However, its revenue guidance for the current quarter came in about $30 million below analyst estimates of $610 million. 🔻

Executives blamed transitory cautiousness from advertisers in specific industries, such as U.S. automobiles and media/entertainment, which are dealing with labor strikes. While spending stabilized in the first week of November, the weakness in October will weigh on this quarter’s results.

Overall, it remains an uncertain advertising environment, with some companies faring better than others. Given the volatility in economic data and Fed policy expectations, many companies are cautiously approaching 2024. ⚠️

Despite the rest of the report being essentially in line with expectations, investors are honing in on the weak revenue guidance. $TTD shares fell 30% after hours, probing the lower end of their multi-year trading range.