The last twelve to eighteen months have been tough for retailers as consumers recovered from their pandemic-fueled shopping sprees. Some companies navigated this period better than others, with Target being one that failed to adjust in a timely manner.

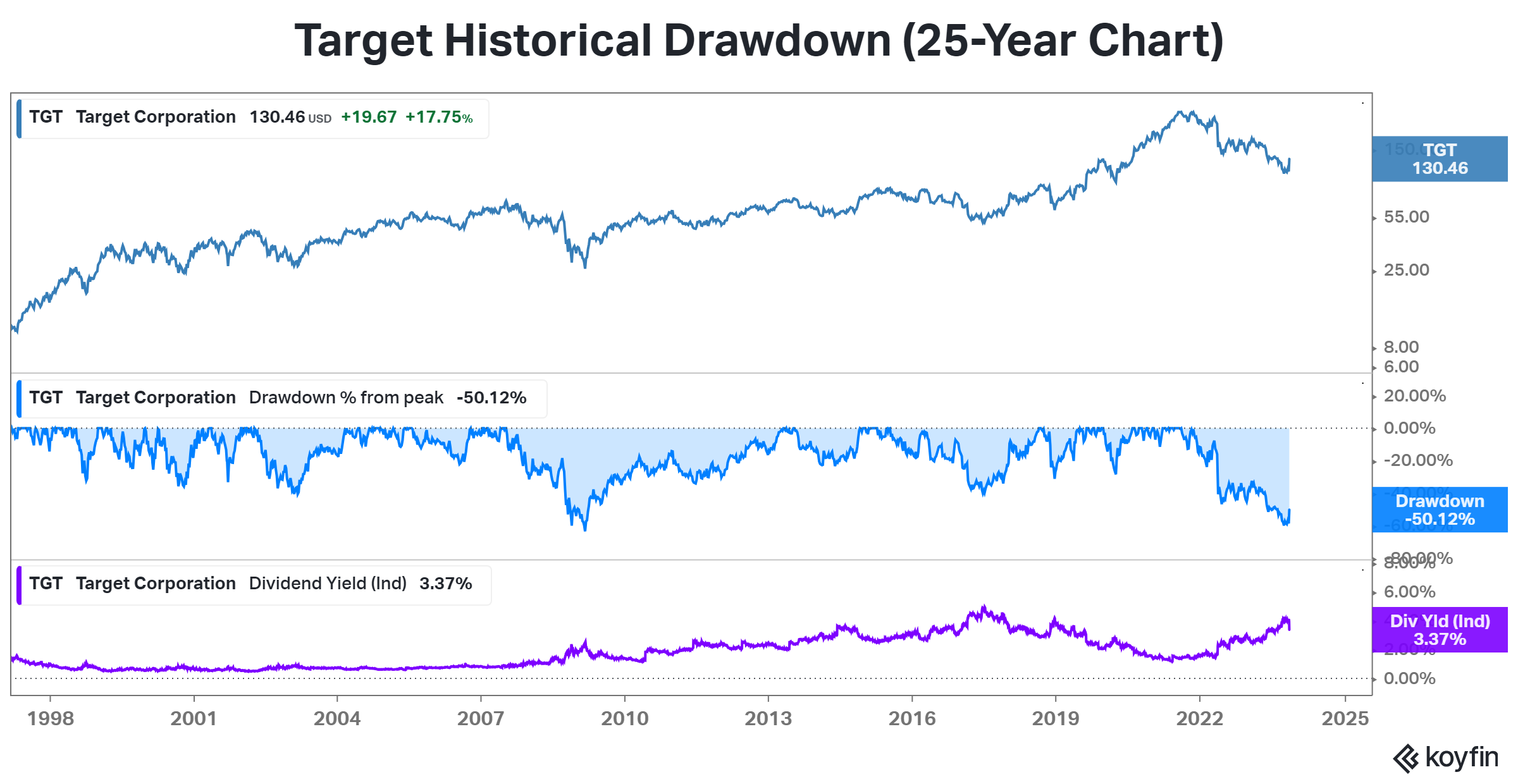

A range of issues pushed the stock lower, including poor inventory management, crime sprees hitting its stores, and a product mix that didn’t match customers’ expectations. Management’s inability to address these factors led to the stock’s largest drawdown since the great financial crisis. 😮

However, the big-box retailer showed some signs of getting back on track when reporting third-quarter results. Its earnings per share of $2.10 on revenues of $25.4 billion topped the $1.48 and $25.24 billion anticipated by analysts.

With a slow sales environment, management’s efforts to address inventory and costs over the last year are finally paying dividends. Inventory levels fell 14% YoY while lower freight costs and other factors reduced the cost of goods sold. Gross margins expanded from 24.7% to 27.4%, while operating margins rose from 3.9% to 5.2%.

In regards to its revenue, overall comparable sales dropped 4.9%. Breaking that out, transaction volumes fell 4.1% YoY, and the average transaction amount fell 0.8% YoY. Additionally, store-based comparable sales fell 4.6% YoY, and digitally originated sales fell 6.0%. 🔻

Sales, general, and administrative (SG&A) expenses as a percentage of revenues rose to 20.9%, as the retailer relies more on promotional activity to drum up sales. Consumers continue to delay discretionary purchases, instead spending most of their funds on lower-margin necessities like grocery items. 🛒

As a result, management expects the holiday quarter to look similar, with a mid-single-digits YoY sales decline. Overall though, investors were happy to see the company get a handle on costs and place itself in a stronger position heading into 2024.

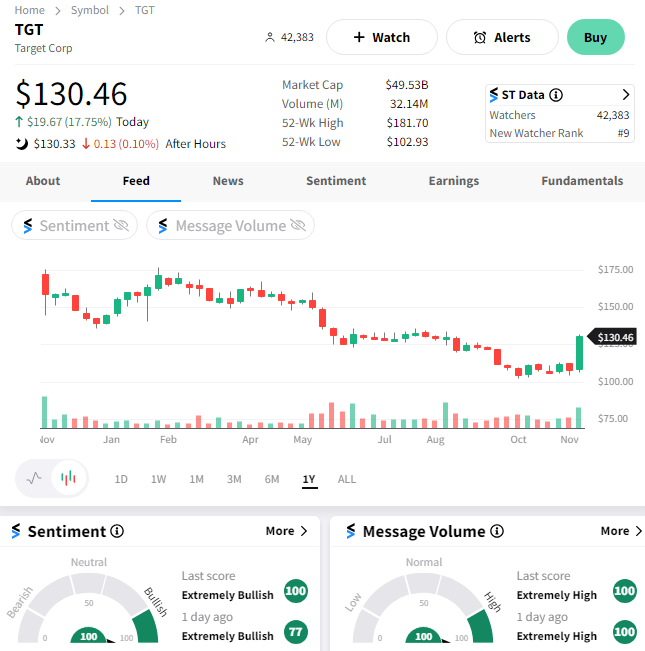

$TGT shares had their best day since August 2019, rising 18% to nearly 3-month highs. Our community is bullish on the turnaround story, with activity and sentiment readings sitting at extremes as the market closed. 🐂

We’ll get more information from Walmart tomorrow before the bell. But as of now, most retailers are providing cautious outlooks for the holiday quarter. The lower and middle-income consumer brackets remain challenged by inflation and falling savings levels. As a result, many expect this upcoming shopping season to be light, including FedEx, UPS, Home Depot, and now Target. ⚠️

Recent U.S. economic data is also pointing towards that as well.

October retail sales recorded their first headline monthly decline since March, falling 0.1% MoM vs. expectations of 0.3%. Sales excluding auto and gas rose 0.1%, suggesting that consumers continued to spend despite concerns about inflation and the economy. Some analysts suggest October’s number is a sign of further weakness to come, given the third quarter’s pace of spending came in at “unsustainable levels.” 🛍️

As always, there will be pockets of opportunity in the market. For example, off-price retailer TJX Companies. raised its full-year guidance for the third time this year and expects a robust holiday shopping season as consumers trade down to lower-priced options.

Time will tell, as it always does. We’ll keep you updated on the consensus view as more retail earnings roll in. 👀