While it may seem like last year’s regional banking crisis is well behind us, investors were reminded today that many of the core risks remain. New York Community Bancorp’s earnings were horrendous, so let’s break down the key points. 📝

The New York-based bank reported a fourth-quarter adjusted loss of $0.27 per share, while analysts expected $0.26 in earnings. Revenues of $886 million and net interest income of $740 million missed estimates of $929.5 million and $788.1 million, respectively. 🔻

Net charge-offs rose from $24 million in the third quarter to $185 million, primarily due to two loans. The first was a co-op loan customized to pre-fund capital expenditures. The loan is not currently in default, but the company is choosing to sell it in the first quarter. The second was an office loan that went nonaccrual during the third quarter after its updated valuation.

The bank said, “Given the impact of recent credit deterioration within the office portfolio, we determined it prudent to increase the allowance for credit losses coverage ratio…” And given that roughly 46% of the bank’s loans are in the commercial real estate sector, investors are concerned that more nonperforming loans and “fire sales” are ahead. ⚠️

Also, the acquisition of Signature Bank last year was a double-edged sword. NYCB now meets the regulatory definition of a Category IV bank, forcing it to meet the regulatory capital requirements of banks with $100 to $250 billion in assets. As a result, it had to cut its quarterly dividend from $0.17 per share to $0.05 to speed up the process of meeting this requirement. ✂️

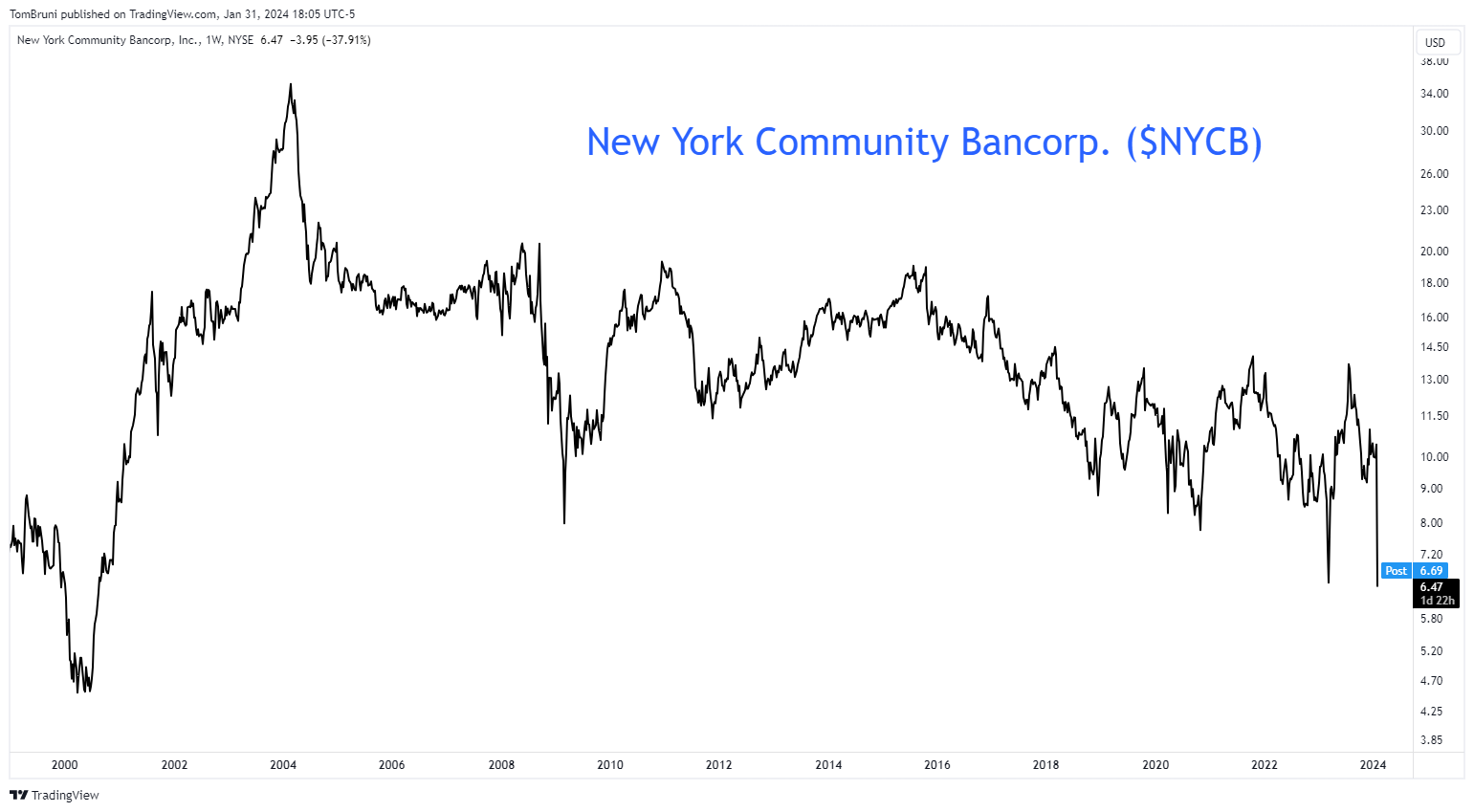

Overall, investors were not happy with what they heard. Obviously the dividend cut stings, but management’s inability to preannounce and communicate a clear forward operating plan really pushed shareholders over the edge. With $NYCB shares trading at 24-year lows, the Stocktwits community’s sentiment is in “extremely bearish” territory. 😡