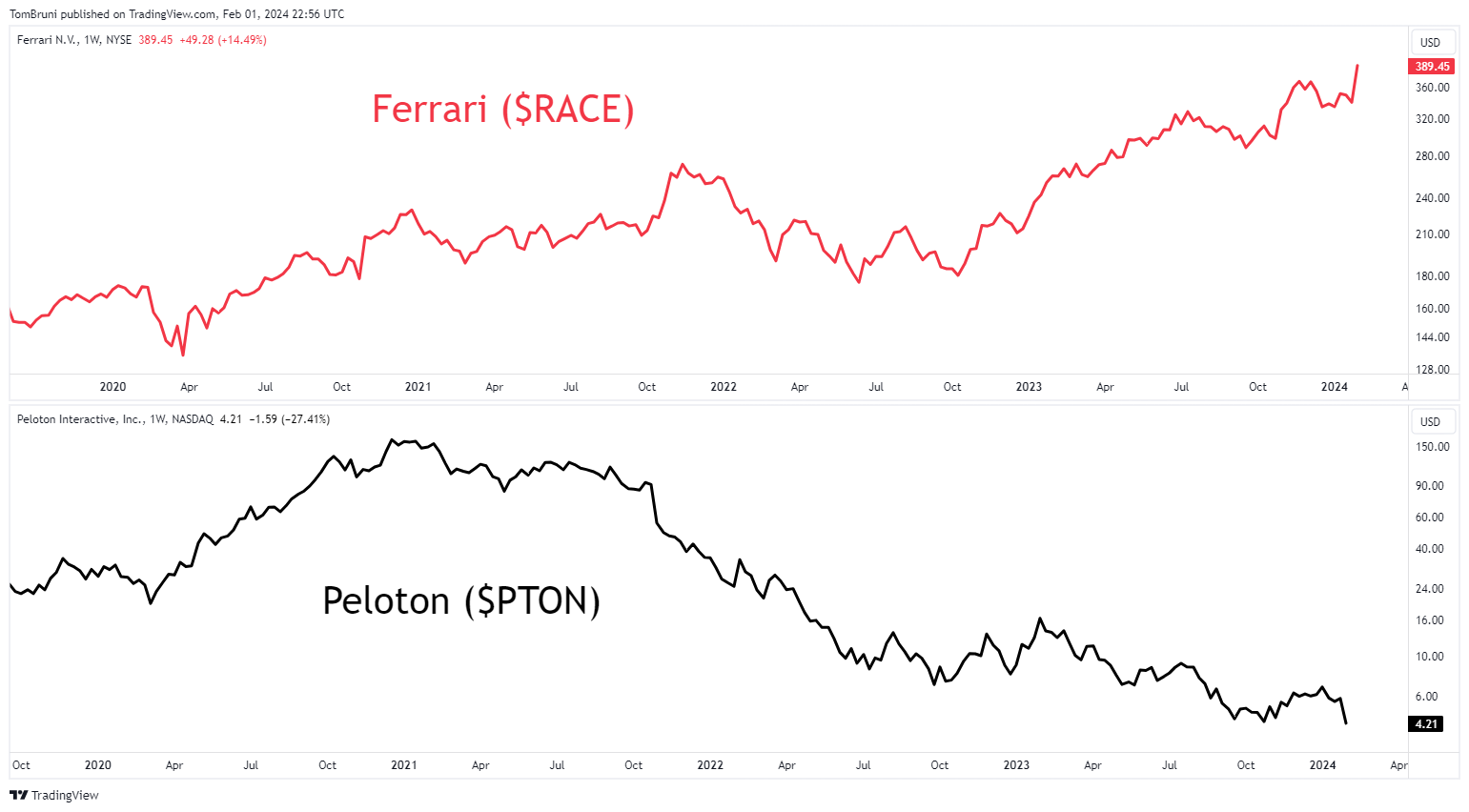

Today, we’re looking at two companies in the vehicle space: one that goes very fast and another that doesn’t move at all. In terms of stock prices, one is making all-time highs, the other all-time lows. 👀

Starting with luxury sports car manufacturer Ferrari, the automaker closed out 2023 with a record year of profits. Full-year revenues jumped 17%, with net profits of $1.36 billion. However, these records are expected to be short-lived…with management anticipating business momentum to continue in 2024. Additionally, shares were supercharged by reports that Formula 1 star Lewis Hamilton could make a surprising move from Mercedes to Ferrari in 2025. 🏎️

Meanwhile, stationary bike manufacturer and fitness company Peloton plummeted again following its results and outlook. The company’s loss per share of $0.54 was $0.01 larger than expected, while revenues of $743.6 million narrowly topped estimates. Once again, its guidance came up short, forecasting a third-quarter adjusted EBITDA loss 10-15x larger than analysts anticipated. 🚲

After two years of executing Barry McCarthy’s turnaround plan, its results have failed to deliver. It now expects sales growth by the end of June, but many investors aren’t waiting around to find out.

$RACE shares soared to fresh all-time highs, while $PTON shares dipped to new lows. Despite coming into today in extremely bearish territory, the Stocktwits community has surprisingly turned extremely bullish on Peloton after today’s news.

We’ll have to see if that optimism pays off. As the fitness saying goes — no pain, no gain, right? 🤕