This morning’s release of the government’s third estimate of GDP is not usually a major event… but it was today. 😲

The final Q3 GDP was revised higher to 3.2% from the previous 2.9%. Analysts have historically considered this a neutral to bullish reading, but this time was different.

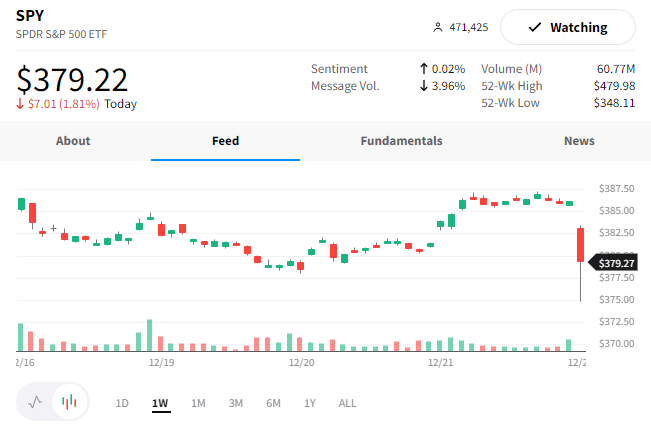

With the labor market still strong/not retreating and revised higher GDP numbers for Q3, the fear that the Federal Reserve will keep ticking rates up is very real.

Despite the upcoming holiday break, next week will undoubtedly be another anxiety-filled time for investors with December consumer confidence results, November pending home sales, and Chicago PMI numbers coming in. 😯