This week we get the last two inflation reading’s before the Federal Reserve’s next meeting on March 21-22. And while the market is mainly focused on the banking sector, the inflation data still does matter. So let’s see what we got… 👀

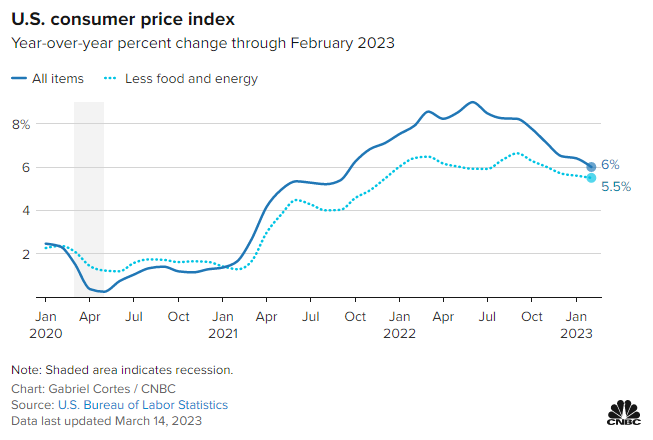

The headline consumer price index (CPI) was +0.4% MoM and +6.0% YoY, both in line with expectations. However, excluding food and energy inputs, core consumer prices rose by 0.5% MoM and 5.5% YoY. That monthly number was 0.1% higher than expected.

Within that core number, used car and truck prices fell 2.8% MoM, bringing the YoY decline to 13.6%. But services inflation remained sticky, with transportation services rising 1.1% MoM and shelter rising 0.8% MoM. 🏘️

The rise in shelter prices accounted for over 60% of the core consumer price index’s rise in February. The other significant factors included vehicle insurance (+14.5% YoY), household furnishings and operations (+6.1% YoY), recreation (+5.0% YoY), and new vehicles (+5.8% YoY).

Overall, the market seemed to take this number well. The optimistic view is that there remains a significant lag in how shelter prices are calculated in the CPI and that real-time indicators suggest shelter price growth has decelerated. It’s just a matter of time before it reflects in the official data. 🐂

However, the pessimistic view is that, as the CNBC chart below shows, the pace of deceleration in core consumer prices is slowing. And with inflation still well above the Fed’s 2% long-term target, the stalling of downward progress could signal a real risk of inflation turning back higher. Especially if the labor market remains strong and/or the recent turmoil in the banking sector causes financial conditions to loosen. 🐻

We’ll have to see what tomorrow’s producer price index (PPI) tells us. But for now, slightly less downward progress is better than no progress in the market’s eyes.

Meanwhile, the banking sector will also be on the Fed’s radar this week. Let’s see what updates we got today. 📰

First, we had Moody’s cut its outlook on the U.S. banking system from stable to negative, citing a ‘rapidly deteriorating operating environment.’ The move could impact credit ratings and borrowing costs for the sector and/or individual institutions. Ultimately, the rating agency says that the core issues of unrealized securities losses and heavy deposit competition remain. As a result, that leaves some institutions at risk of an adverse event.

The U.S. Department of Justice (DOJ) and Securities & Exchange Commission (SEC) opened probes into Silicon Valley Bank. And the Federal Deposit Insurance Company (FDIC) continues to run the bank’s operations as it looks to restore confidence in the market further. 🕵️

Meanwhile, many bank CEOs took to the media to shore up confidence in their own stocks. Some, like Charles Schwab CEO Walt Bettinger, even put their money where their mouth is. He confirmed that he bought 50,000 shares of the company’s stock during Tuesday’s decline. 💰

Some of the historic moves we saw in regional bank stocks and other assets, like the U.S. 2-year Treasury bond, also reversed today. Most bank stocks and the ETFs that track them experienced sharp rebounds, stemming their week-long declines. The two-year Treasury yield rose 20 basis points after experiencing its largest 3-day decline since 1987. 😮

Overall, the current situation is likely far from over. Investors, depositors, and other institutions’ stakeholders are still assessing the fallout. Moreover, history shows us that significant volatility events are rarely a few-day phenomenon. As a result, most market participants are strapping in for continued swings in these stocks and the broader market.

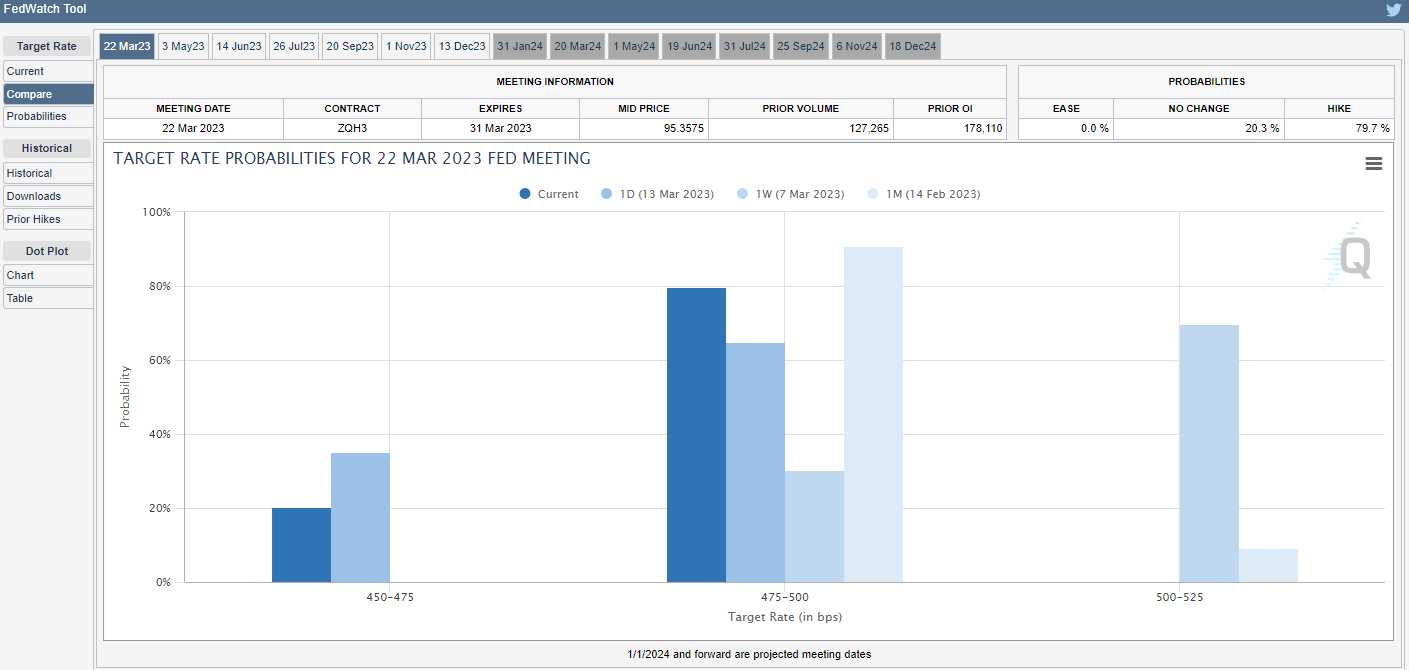

As for its impact on the Fed’s next move…well, we told you the market’s expectations were fickle. Just last week, the market priced in a 70% chance that the Fed would hike 50 bps at its March meeting. But after this week’s events, it’s assigning a 0% probability of that happening. Instead, there’s an 80% chance of a 25 bp hike and a 20% chance the Fed leaves rates unchanged. 🔮

And if you needed any further evidence that nobody knows what’s ahead, just read some of Wall Street analysts’ thoughts. They’re all over the place… 🎯

Lastly, while we’re on the topic of inflation, it’s worth mentioning crude oil prices. Today they closed at their lowest level since December 2021. While that’s good for inflation, it could also mean the market is pricing in lower demand as bank sector turmoil reignites recession fears. 😬

Overall, all of these data points will be factors in the Fed’s decision next week. Right now, the market is betting it’ll back off its aggressive tightening in light of recent events. If so, that would likely be a positive for tech stocks and other long-dated assets, which is why we see the Nasdaq 100 holding up best among all the major U.S. indices.

Whether the market is correct in its assumptions remains to be seen. For now, all we can do is wait and see. 🤷