Manufacturers, retailers, and other players have been telegraphing a Personal Computer (PC) slowdown for several quarters. The questions have always been how long it would last and how deep the slowdown would be. Today we got a bit more color on the current environment.

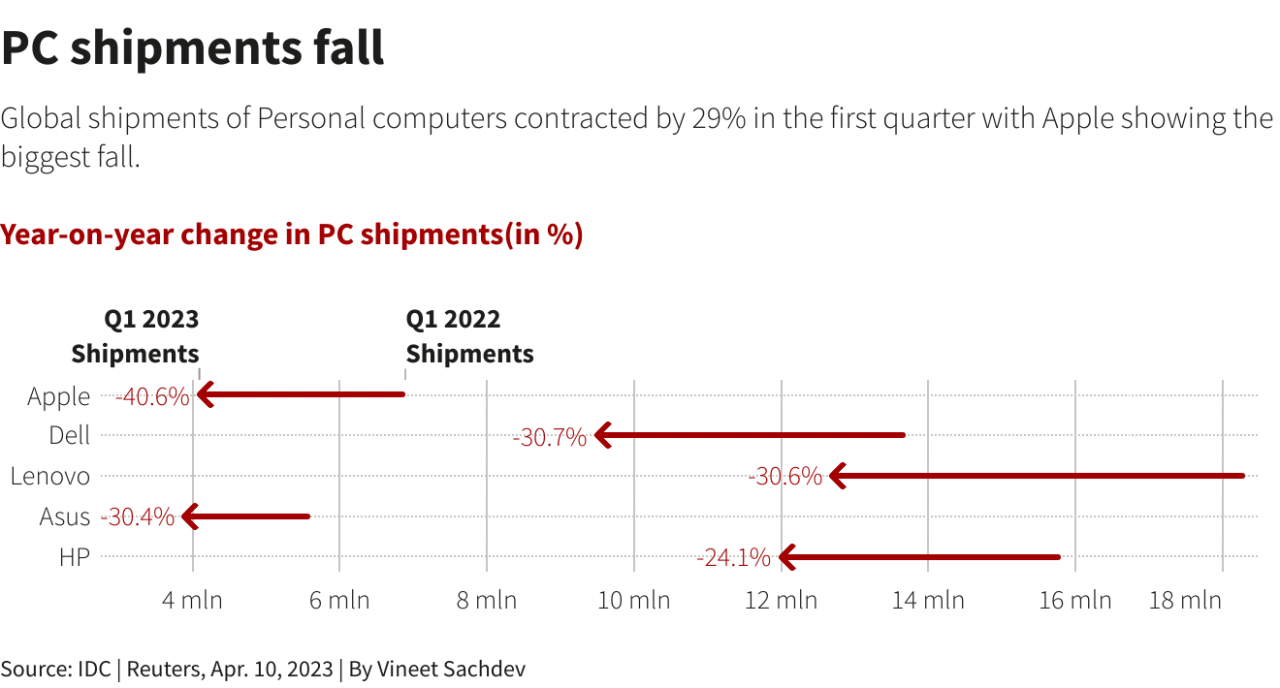

Market research firms IDC and Canalys each put out separate reports today indicating that global PC shipments in Q1 fell by roughly 29% YoY. Their research suggests that Apple fared the worst, with shipments falling nearly 41% YoY. Competitors Dell, Lenovo, Asus, and HP closely followed. 🔻

After initially failing to keep up with demand due to supply chain issues, retailers overordered so that they’d be able to meet demand. However, COVID-driven demand proved unsustainable, particularly given rising inflation and a weakening economic outlook. That left retailers with a lot of excess product on their books. 📦

Many analysts expect high inventory levels and significant price discounts to continue through the second quarter of ’23. But on the positive side, the slowdown is allowing supply chains time to stabilize after a rough two years. This gives many companies, including Apple, time to explore production alternatives outside China. 🏭

Both firms’ research reports predict a recovery later this year and into 2024 if the economic outlook improves. However, other analysts point to widespread cost-cutting efforts and a Federal Reserve focused on crushing demand as indications that the market will remain sluggish.

Meanwhile, on the semiconductor side, Micron Technology surged on reports that Samsung Electronics is cutting its near-term memory chip production. Chip manufacturers had previously acknowledged the slowdown but indicated they’d continue investing heavily as long-term demand for chips remains strong. With that said, near-term challenges remain as their clients pare down existing inventory before placing new orders. ✂️