Whether we’re talking about central or regional banks, a lot is impacting the sector right now.

Let’s start with April’s producer price index (PPI), which rose less than anticipated. The headline measure of final demand goods and services rose just 0.2% MoM vs. the 0.3% expected. And its 2.3% YoY increase was the lowest reading since January 2021. Core producer prices, which exclude food and energy, rose 0.2% MoM, as expected. 🌡️

As we’ve discussed with consumer prices, services are also driving the majority of price gains here. Roughly 80% final demand index’s rise is attributable to the 0.3% MoM increase in prices for final demand services. And that pressure will unlikely ease up until the historically tight labor market cools significantly.

On that note…today’s jobless claims data added to the growing evidence that the labor market is softening (albeit slowly). Initial jobless claims rose to 264,000, their highest level in 1.5 years. While it’s a bit counterintuitive to say people losing jobs is a good thing, this is precisely the type of data the Fed wants to see as it makes a case for pausing rate increases at its June meeting. ⏸️

While the Fed focuses on the economy, investors and traders focus on regional banks. Despite public and private sector efforts to restore confidence in the financial sector, conditions remain precarious.

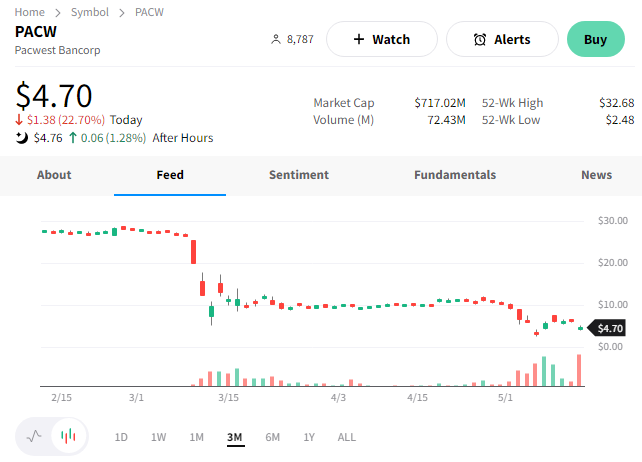

Regional banks remain under pressure, with the Regional Bank ETF $KRE approaching a new closing low. Partially driving that was PacWest Bancorp shares falling 22% after its deposits declined 9.5% last week. It’s clear that concerns about its financial health continue to spiral. And some traders are even betting it’s the next to fail… 😬

Meanwhile, Jamie Dimon was back in the news. The JPMorgan Chase CEO warned that markets will panic if the U.S. cannot put a plan in place to avoid a debt default. He says fears of a debt default would ripple through an already vulnerable and anxious financial system. He also made headlines for saying U.S. regulators should consider a ban on short-selling bank stocks. 🚫

Sounds like he’s still a bit worried about the financial system’s health. On the other hand, the Federal Deposit Insurance Corporation (FDIC) is still trying to recover after a busy few months. It needs to refill its coffers so that it can step in again if needed. As a result, it’s asking 113 of the largest U.S. lenders to bear the cost of replenishing the $16 billion it spent during the recent bank failures. 💰

A lot is happening, from the debt ceiling and inflation to regional bank stocks. As always, we’ll do our best to keep you updated. For now, let’s try to make it to the weekend without another bank stock going out of business… 👍